Comments

- No comments found

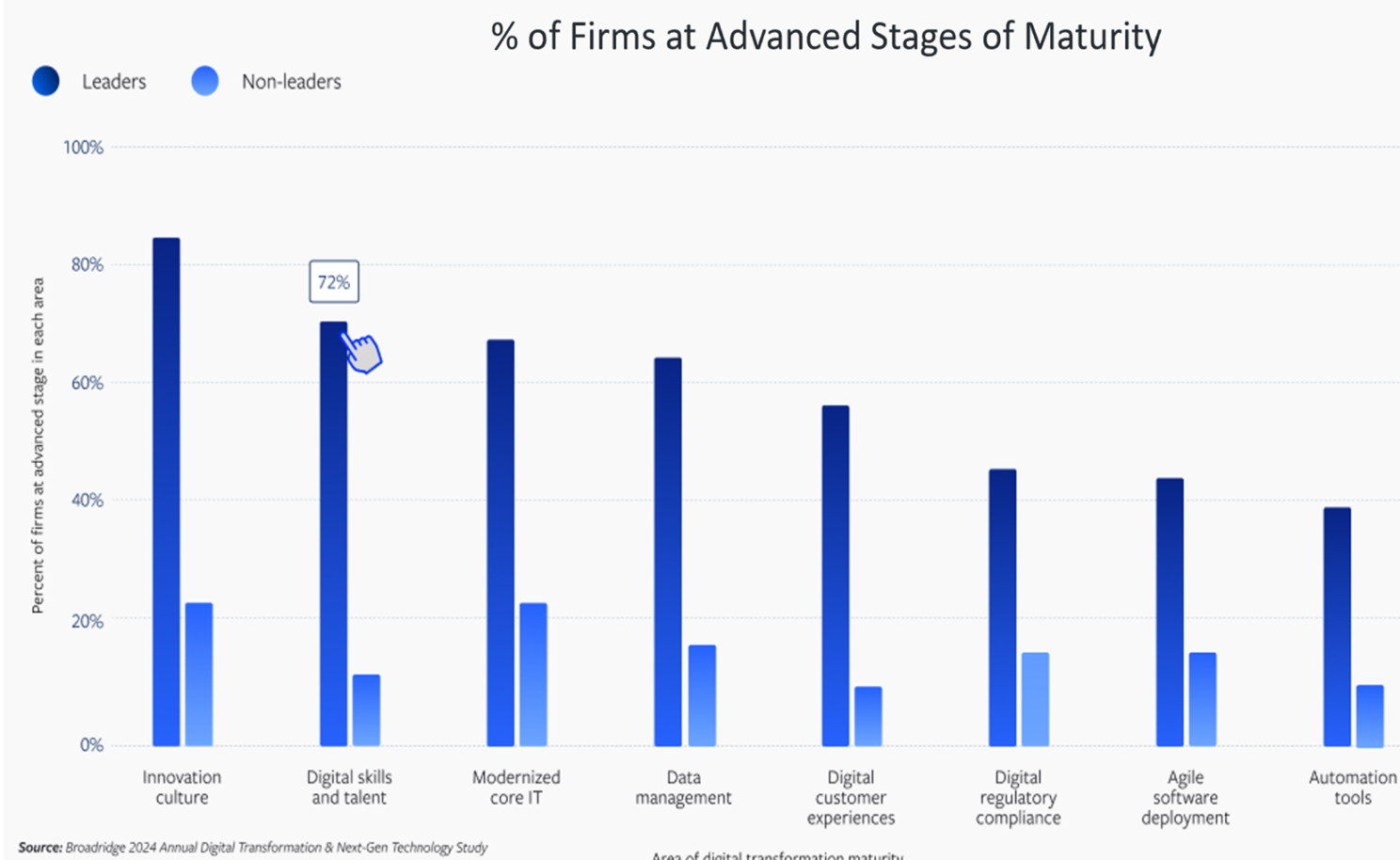

Mind the ‘Digital Transformation’ Gap! New research by Broadridge highlights the significant gap emerging between the financial organizations which are leading in digital transformation vis a vis those who are falling behind.

As an example, 44% of ‘leaders’ (see appendix for definition) are making moderate to large investments in GenerativeAI — that’s more than twice the level of ‘non-leaders’. So, whilst an overwhelming 75% of executives express confidence in their technology transformation roadmap, a clear digital maturity gap is emerging too.

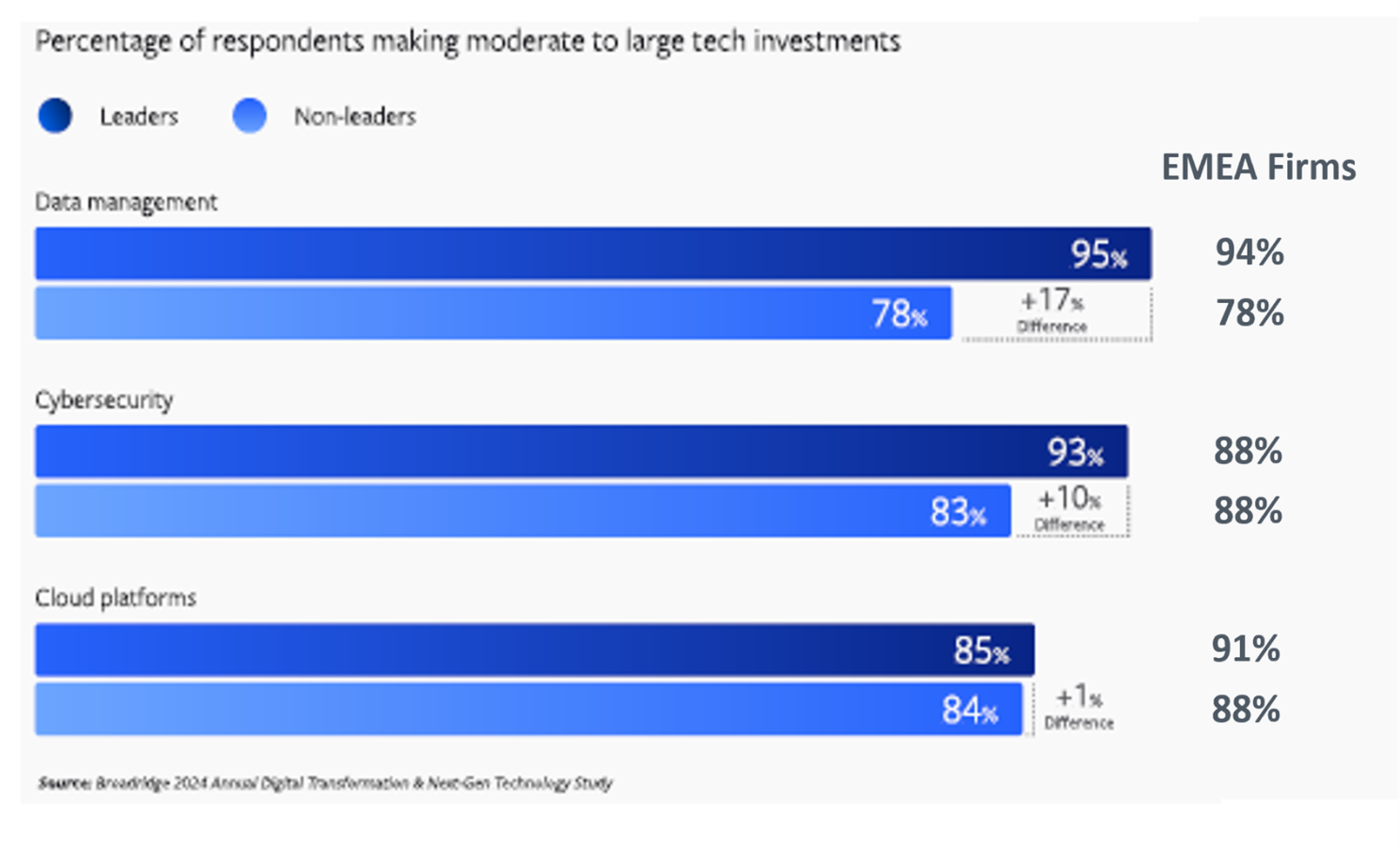

And the key components of this gap between leaders and non-leaders? It lies in investments and ‘intention/perception to action’ alignment gaps, right across technology, culture and talent. The research also deeply explores the adoption of next-gen technology and how this is being balanced with ongoing spending on core IT, including cloud, cybersecurity and data management technologies – in so many ways, in the Age of AI, data considerations do remain such a differentiator.

Key areas of investment increase over the next two years, namely AI (21%), Blockchain and Distributed Ledgers (20%) and Robotic Process Automation (14%) are also foregrounded, alongside growing trends around customer-centric investments, cybersecurity, ‘unleashing’ AI, a ‘coming of age’ for Blockchain and the criticality of ‘people powered’ innovation.

To unpack more, it was a pleasure to discuss some of the insights from this study in person with its architect and leading members of the Broadridge team. Here are some further key reflections on the most pertinent takeaways, whilst leaving you room to explore more personally too – there is an absolute wealth of data insights to dive into! The study is freely available to view here and marks the 4th iteration of an annual survey of senior financial services executives from 500 financial institutions and across 18 countries - by Broadridge, a leading provider for the critical infrastructure that empowers investing, corporate governance, and communications to enable better financial lives.

🔸 More than 80% of firms are prioritising investments in their core IT platform, including cloud, cybersecurity and data management

🔸 75% of global respondents say they are confident about their organisation’s digital transformation and the progress they are making

🔸 70% of firms are prioritising investments in AI with 52% prioritizing AI investments in customer interaction to fuel stronger and more meaningful customer engagement

🔸 Globally 55% of executives believe the rise of AI will create a greater need for humans to possess analytical and critical thinking skills

🔸 Over the next two years, firms plan to increase investment in DLT by 20%, which only slightly lags behind AI (21%) – likely linked to the finding that 36% of respondents agreed that blockchain and DLT will reduce the need for intermediaries such as custodians and clearing houses

🔸 Executives cite cybersecurity risk as top challenge inhibiting transformation (35%)

🔸 Executives see focusing on customer obsession ‘with priorities deeply rooted in client needs’ as the top accelerator of transformation

🔸 Intention/Perception to Action Gaps persist – more below!

As highlighted above, over two-thirds of financial organizations have made meaningful progress on their core modernization efforts, balancing ongoing spending on their core IT, including cloud, cybersecurity and data management technologies with an eagerness to invest in areas such as AI and Distributed Ledger Technologies (DLT). The new research finds respondents plan to increase their technology investment over the next two years, with a particular focus on AI (21%), Blockchain and distributed ledgers (20%) and Robotic process automation (14%) – all figures are averaged.

Looking deeper, the priority areas for AI investments differ across business functions, with Customer interaction the leading Front Office AI priority at 52%, Risk and Fraud Management for Middle Office and Back-Office AI at 43% and with respect to Corporate and IT AI priorities, the leading investment is within Data Security and Privacy (34%) – and these are all investment areas set to see significant increases in the next two years too. It is also noticeable that finance sector leaders are more likely to prioritize AI for areas that are more embedded to strategy and have differentiated themselves through the data that is proprietary to them. This addresses a key challenge that I see recur across other studies, namely ‘intention/perception’ to ‘action’ gaps.

A range of examples emerge within the Broadridge research, for example whilst customer obsession is cited as the leading transformation accelerator, less than a quarter (22%) of those surveyed are actually at the advanced stages of offering seamless digital experiences. And this matters – PwC finds 1 in 3 customers are willing to walk away from a brand they love after just one bad experience, rising to 92% after 2 or 3 poor experience interactions. Conversely, companies with integrated omni-channel customer engagement strategies are able to retain 89% of their customers (Invesp).

Additionally with relation to GenAI and skilling, whilst Broadridge finds some 45% of firms report allowing staff to use GenAI tools for work purposes, only 25% are training staff in how to use GenAI tools. This is particularly pertinent given AI guardrail needs especially relevant to LLM models. Putting this into context further, 55% of financial firms reported believing the rise of AI will create a greater need for humans to possess analytical and critical thinking skills – yet the majority (54%) have not yet defined a clear strategy for reskilling and training staff to wholly support this.

In respect to perspectives gaps, a key example is seen across business and technology roles, with ‘tech executives, who often understand the risks of an insecure environment more than other senior leaders, tend to care more about cybersecurity than business executives’. Given that cybersecurity was identified as the top capability executives expect from third-party vendors and taken alongside the rise in governance legislation - in particular the introduction of NIS2 and the new personal accountability this brings to C-Suite level - addressing this gap becomes an imperative. I also personally see an opportunity here for the greater pairing of blockchain and AI technology to move beyond transparency to accountability in governance and compliance.

As highlighted above, focusing on the human part of change and not just technology, alongside fostering an innovation culture with a ‘fast-fail’ mentality is absolutely critical. This is demonstrated as challenging to achieve for non-leading institutions, so how can this be better supported? And especially when related studies, for example by SAS, have also highlighted people gaps – for example, 60% of decision-makers admitted they cannot find enough people with AI and Machine Learning skills, but over half (54%) of businesses have already invested in these very capabilities.

I believe there is actually a real opportunity here to apply AI to address some of these people challenges, for example to help identify personal learning styles (metacognition) and help cultivate more personalised-organisational development programs – even more key when we consider growing evidence of the link between (lack of) skills development and propensity to leave an organisation, at a time of growing supply-demand talent gaps.

Finally, and reflecting back on the greater need for people to possess analytical and critical thinking skills that was identified in the Age of AI, this brings to the fore, what other skills are critical too? For me, this lies in the rise of STEAM learning approaches and an equal valuing of skills such as curiosity and emotional intelligence as well as technology disciplines, alongside a focus not only on democratization of access to learning but support in developing the confidence and context to apply these new skills too.

And there really is much more to explore in the research! As a reminder, the study is freely available to view in full here – all feedback and follow-on questions most welcome.

Many thanks, Sally

The Broadridge survey was conducted by the ThoughtLab Group with the purpose to better understand how financial services companies are digitally transforming and adopting next-generation technologies. The regional breakdown for its global distribution across 18 countries is: 49% North America, 27% Europe and 24% Asia Pacific. A key feature of this study is its classification of companies into technology leaders or non-leaders based on a variety of criteria, for example adoption of automation, innovation culture and having a modern core IT infrastructure. Under this methodology, the financial services companies which scored in the top quartile were classified as leaders.

A highly experienced chief technology officer, senator for advanced technologies, and a global strategic advisor on digital transformation, Sally Eaves specialises in the application of emergent technologies, notably AI, 5G, cloud, security, and IoT disciplines, for business and IT transformation, alongside social impact at scale, especially from sustainability and DEI perspectives.

An international keynote speaker and author, Sally was an inaugural recipient of the Frontier Technology and Social Impact award, presented at the United Nations, and has been described as the "torchbearer for ethical tech", founding Aspirational Futures to enhance inclusion, diversity, and belonging in the technology space and beyond. Sally is also the chair for the Global Cyber Trust at GFCYBER.

Dr. Sally Eaves is a highly experienced Chief Technology Officer, Professor in Advanced Technologies and a Global Strategic Advisor on Digital Transformation specialising in the application of emergent technologies, notably AI, FinTech, Blockchain & 5G disciplines, for business transformation and social impact at scale. An international Keynote Speaker and Author, Sally was an inaugural recipient of the Frontier Technology and Social Impact award, presented at the United Nations in 2018 and has been described as the ‘torchbearer for ethical tech’ founding Aspirational Futures to enhance inclusion, diversity and belonging in the technology space and beyond.

Leave your comments

Post comment as a guest