Comments

- No comments found

US federal debt (that is, the accumulation of annual budget deficits) has been rising sharply.

Here, I’ll sidestep the big-picture arguments about how this contributes to a slowdown in US growth rates and the risks of sustained inflation, and raises the longer-term risk of more dire financial crises. Instead, let’s just spell out some facts.

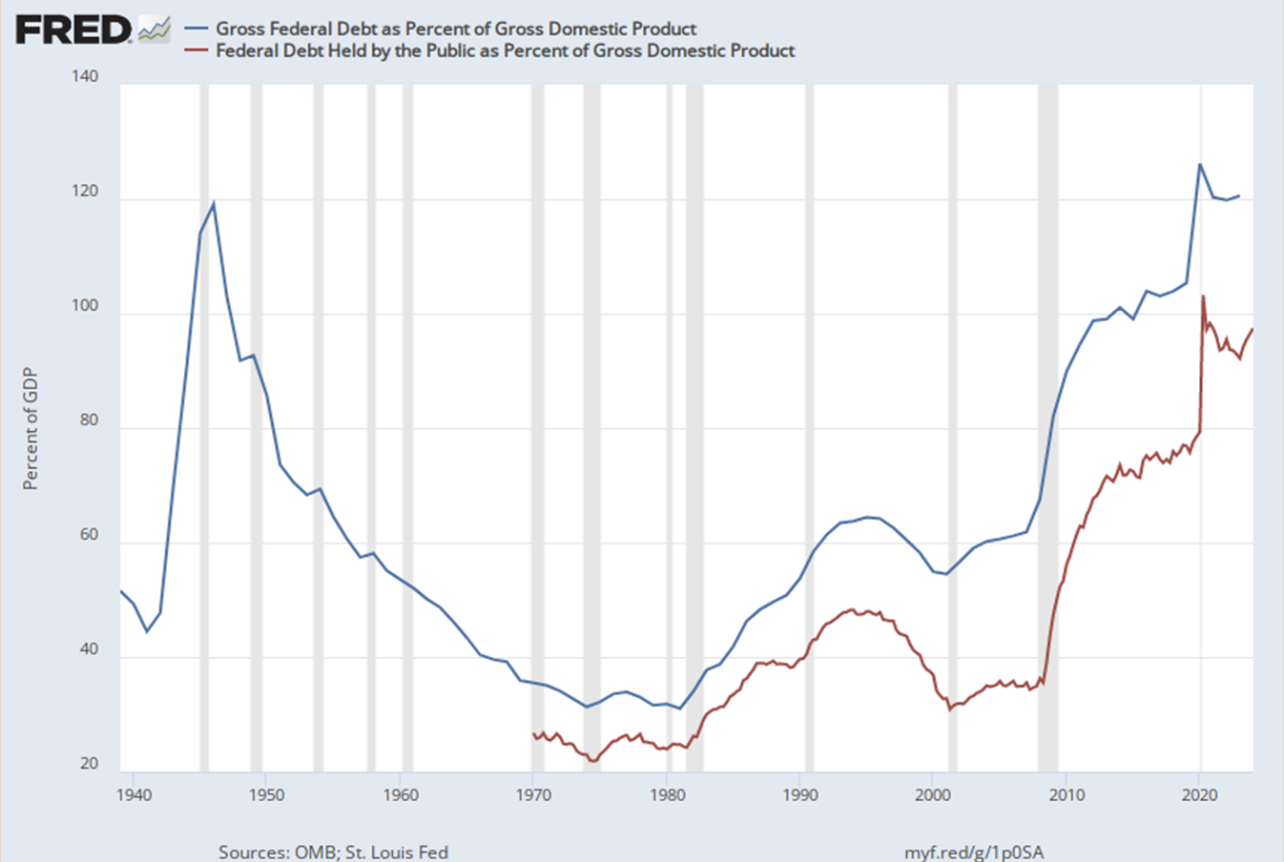

This figure shows the “gross” debt-to-GDP ratio, and the “held by the public” debt-to-GDP ratio. The distinction is that the federal government holds a lot of federal debt itself–especially in the trust funds for Social Security and Medicare, which are legally required to hold US Treasury debt. It’s often more useful to focus on debt held by the public, because this represents what the US government is drawing from capital markets outside the government itself.

As you can see, federal debt held by the public rose in the 1980s, with a combination of high Reagan-era budget deficits and interest rates. But it sagged back in the late 1990s. Federal debt held by the public was around 35% of GDP as recently as 2008. Now it’s up around 95% of GDP–a rise of about 60% of the ginormous US GDP in less than two decades.

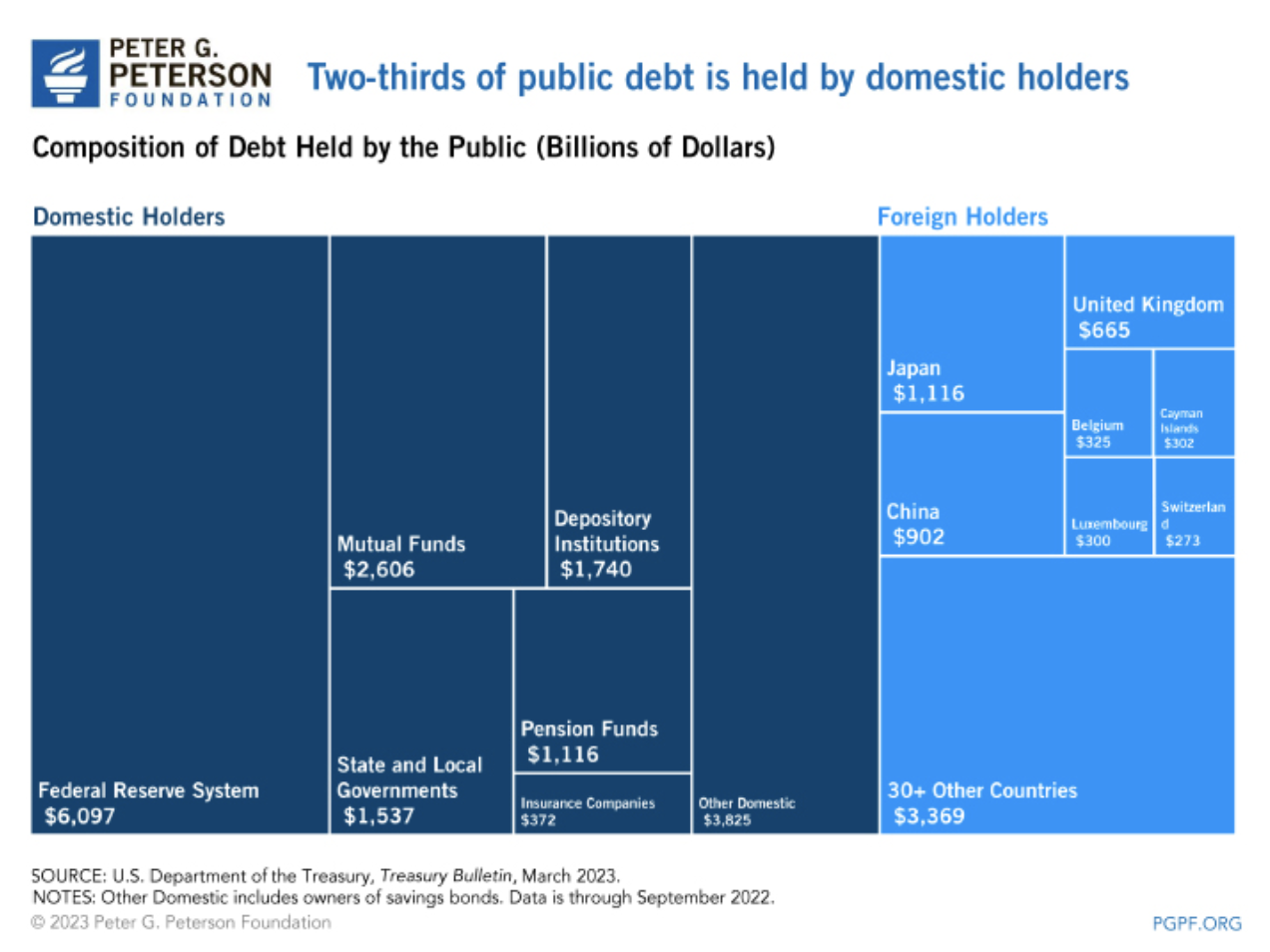

Who is the “public” that is holding federal debt? Here’s a breakdown from the Peterson Foundation, based on the underlying US Treasury data. As you can see, about two-third of the debt held by the public is held by those in the US. Some of these holders are who you would expect: mutual funds, banks, pension funds, insurance companies, other investors. US Treasury debt is sometimes called the “safe asset,” so it will be a natural part of an investment portfolio for many institutions.

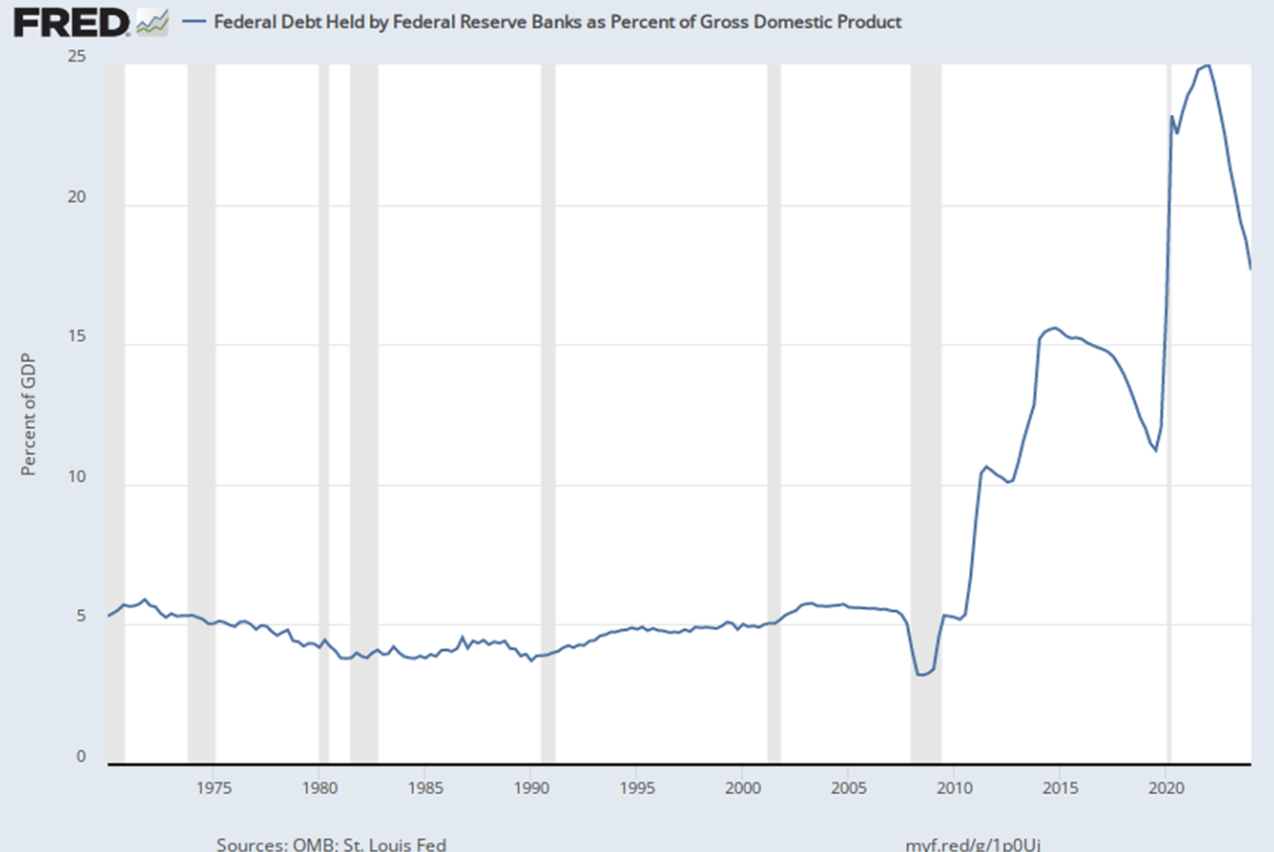

However, one substantial change in recent decades is the rising amount of US debt held by the Federal Reserve system. This figure shows federal debt held by the Fed, as part of its “quantitative easing” program. As you can see, the usual pattern of the last half-century was for the Fed to hold US federal debt equal to about 5% of GDP–an amount used for the Fed’s day-to-day financial duties. But from 2008 to about 2014, when the overall debt-to-GDP ratio rose by about 30 percentage points, the Fed ended up holding about one-third of that debt.

The Fed started to phase down its holdings of federal debt as a share of GDP, but then the pandemic hit, and the Fed stepped in once more, holding even more federal debt. Now, the Fed is again trying to phase down its federal debt holding–the Fed’s appetite for federal debt is not limitless–but it’s still far above the 5% of GDP baseline level that prevailed for the half-century or so before 2008.

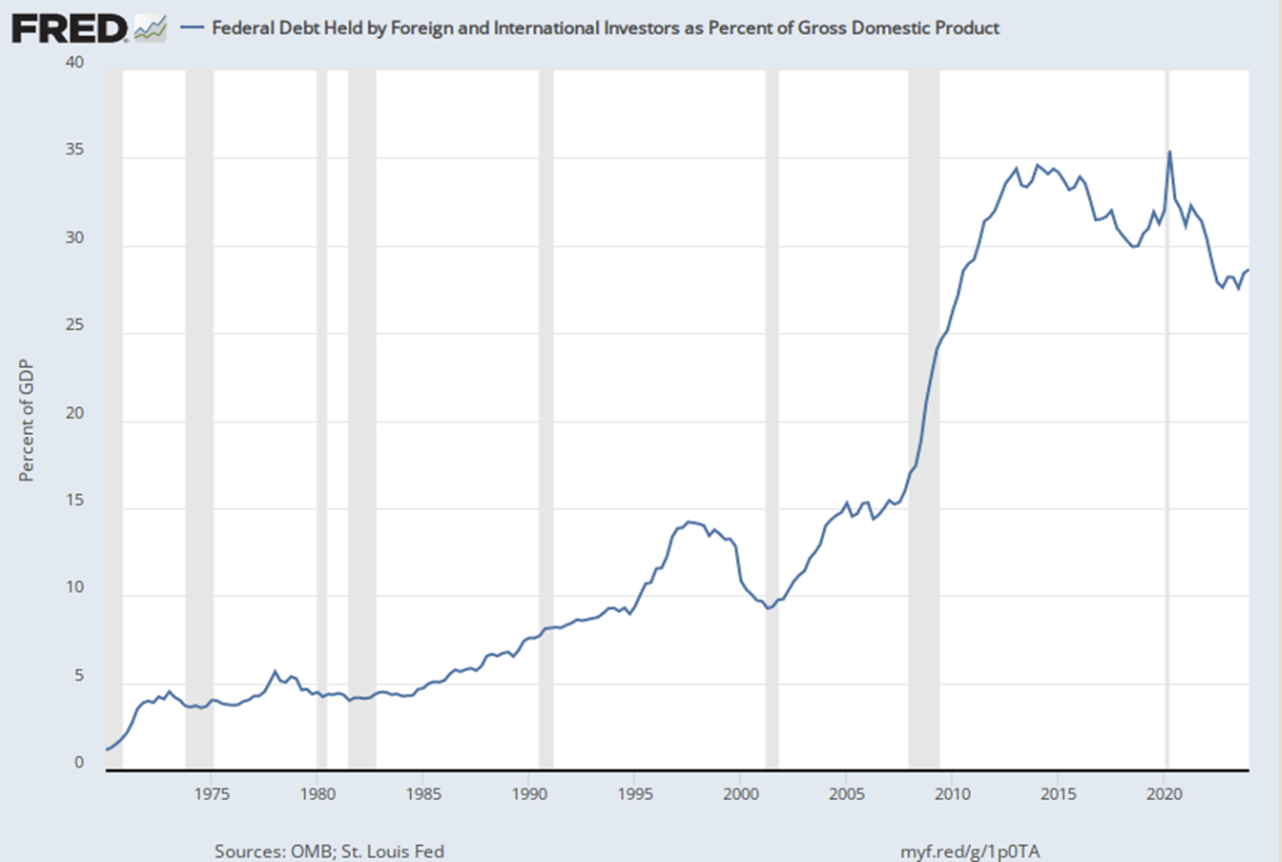

Another big change is the amount of US debt held by foreign investors. The holdings of US federal debt as a share of GDP had been rising over time for a few decades. This isn’t a surprise: again, US debt is the world’s “safe asset,” so it’s a natural part of the portfolio for central banks and private investors in a globalizing world economy. You can also see that when the US debt-to-GDP ratio took off around 2008, the holdings of foreign investors rose sharply–from about 15% of GDP to 35% of GDP, before sagging a little since then. In what seemed like an increasingly risky world economy after 2008, investors around the world wanted to hold more of the “safe asset.” In that sense, paradoxically, the financial crisis of 2008 made it easier for the US government to borrow. To put it another way, US debt held by the public rose about 30 percentage points of GDP from 2008 to 2014, and about two-thirds of that was accounted for by increased foreign holdings of federal debt.

However, since then, and even taking into account the additional rise in the US debt/GDP ratio associated with the pandemic, foreign holdings of US debt as a share of GDP have fallen. The appetite of foreign investors for US debt is not limitless.

There was an argument back in the 1970s, when I was first delving into economics, that the US didn’t need to worry too much about federal borrowing, because “we owed it to ourselves.” Well, the rise in foreign holdings of US government debt means that we now owe about one-third of that federal debt–and the associated interest payments–to others outside the US economy.

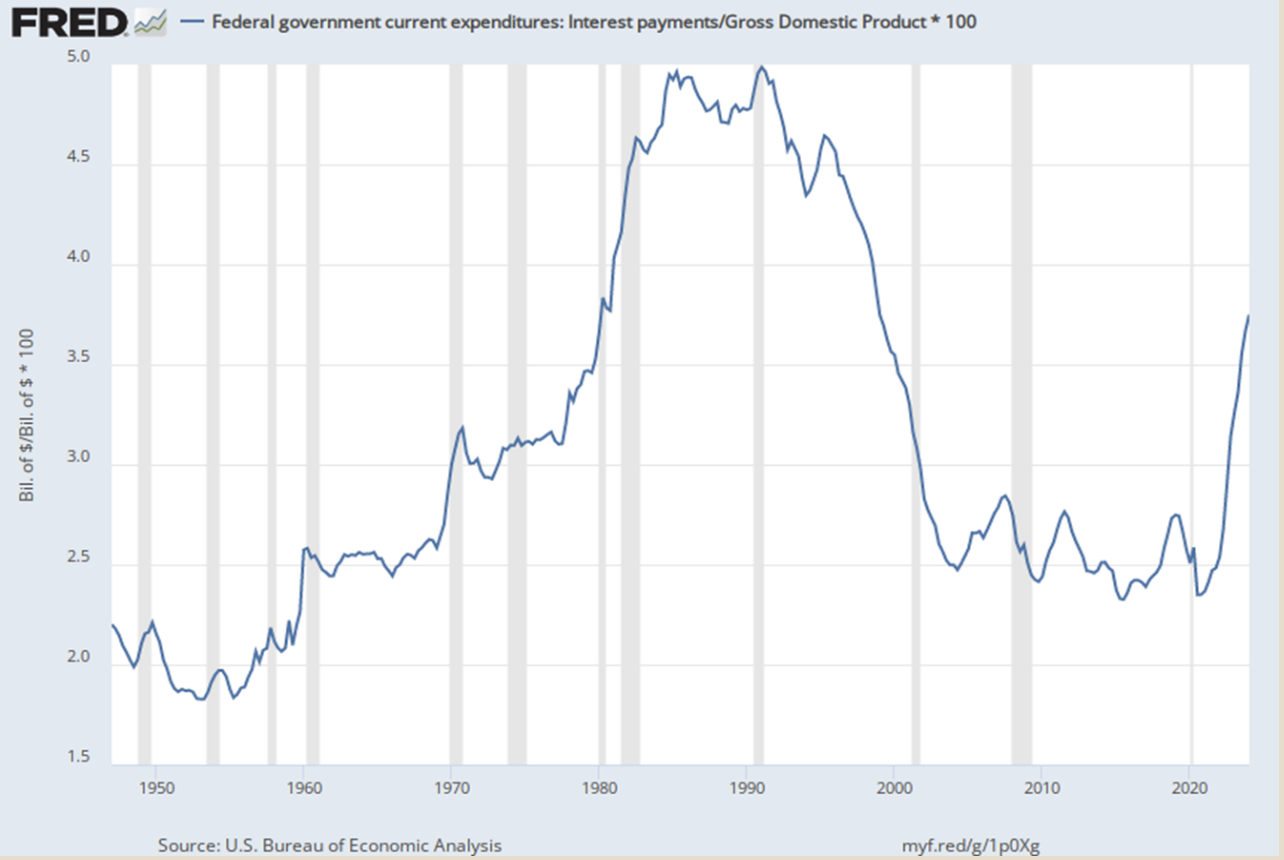

The interest payments owed by the federal government (again, shown as a share of GDP) were relatively low for most of the time since 2000, because of the low interest rates. But with federal debt rising higher and interest rates rising as well, interest payments are spiking. The Congressional Budget Office says that in 2024, federal interest payments will exceed defense spending; by 2025, federal interest payment will exceed Medicare.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest