Comments

- No comments found

One of the most pressing concerns for the U.S. economy today is the mounting national debt, which has now reached nearly $36 trillion.

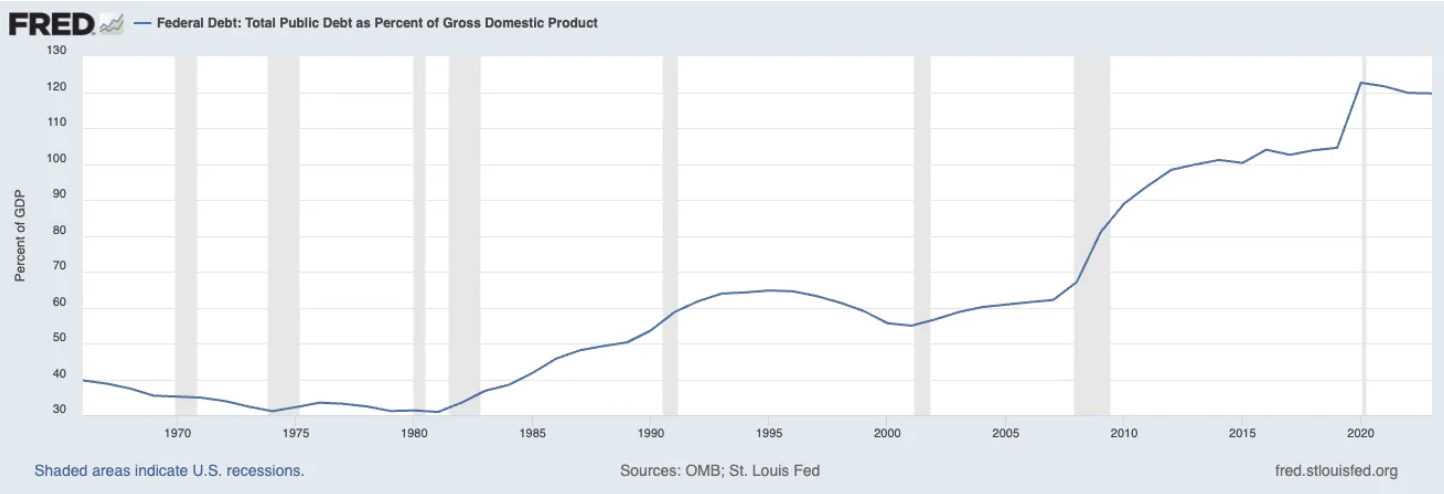

Despite strong economic growth and high employment levels, this increasing debt load raises alarms, especially as it surpasses 100% of the nation’s GDP. To put that into perspective, it’s like owning more than you earn annually—something that would be concerning for a household, and even more so for a country.

What worries me most about the US economy is the debt we have built up at a time of robust growth and employment. Nearly $36 trillion.

As a percentage of GDP, we are over 100%.

Imagine if your mortgage were more than 100% of your annual income. Wait, that’s not so bad. Most borrowers have mortgages greater than their annual income.

It is not uncommon to see mortgages be 3-4x annual income. The critical question is whether or not you can make the mortgage payment. That is supposed to be no greater than 25% of your yearly income.

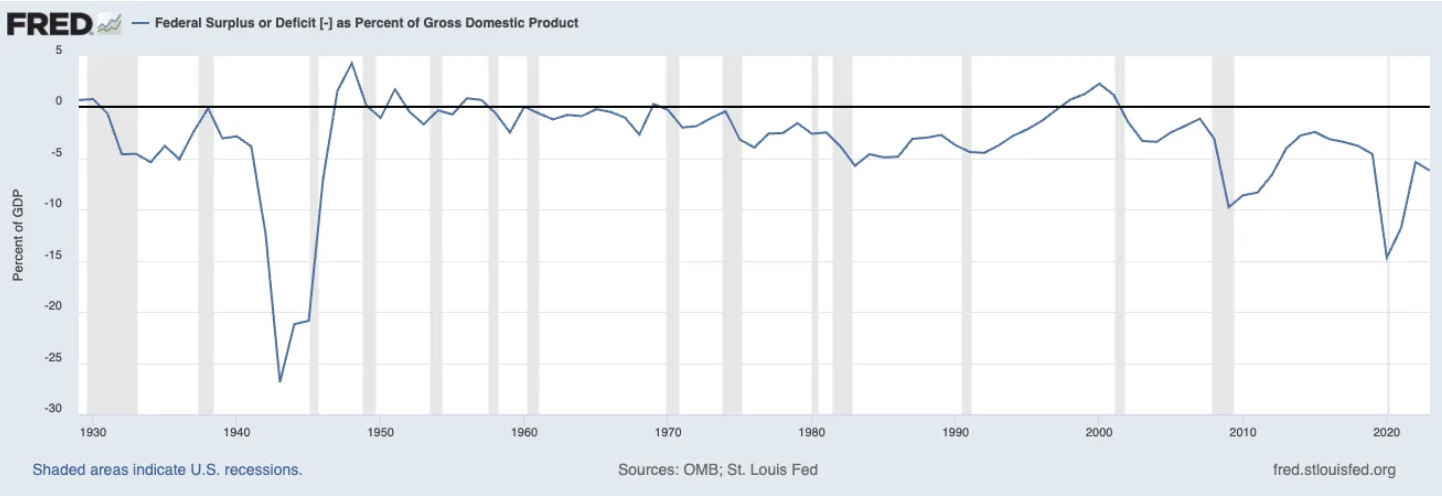

In the case of the US, however, we have been running deficits for a long time.

Given our other commitments—defense and entitlements—interest expense is pushing us into a continuous deficit, which is why the debt is growing.

Japan is often cited as an example of a country that has had a very high debt-to-GDP ratio for decades. So why worry?

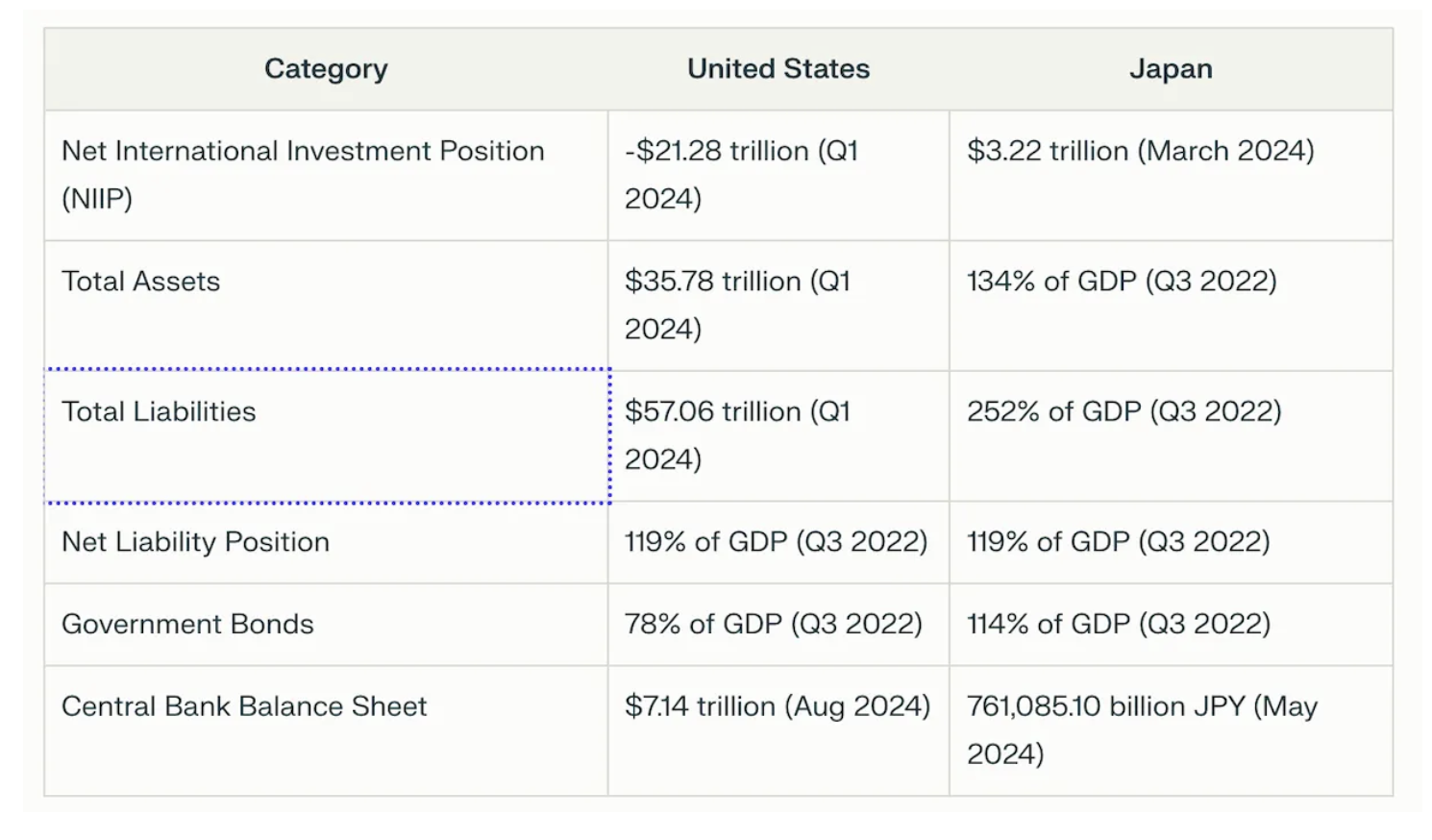

Take a look at the consolidated balance sheets of the US compared to Japan

People often point out that we should not worry in the US because Japan has long run a much higher debt-to-GDP ratio than the US, and things are fine.

Well…yes and no.

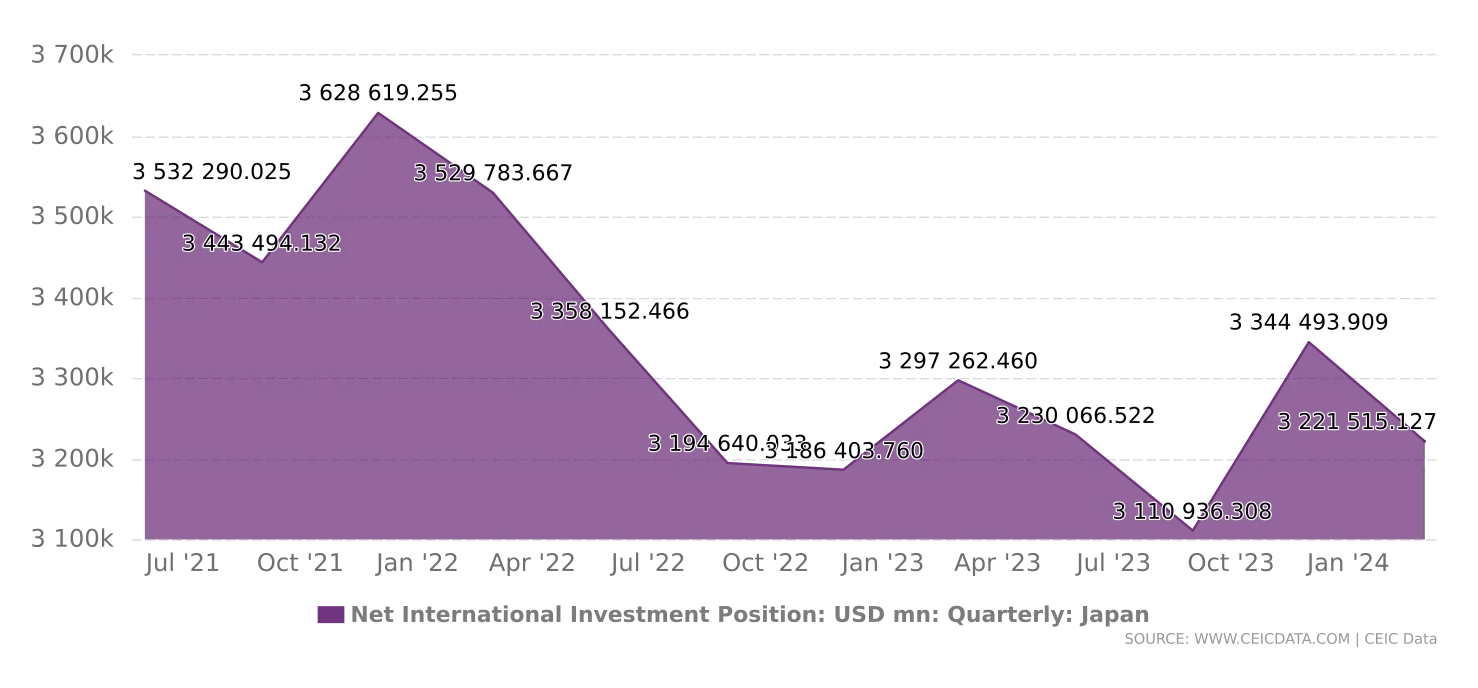

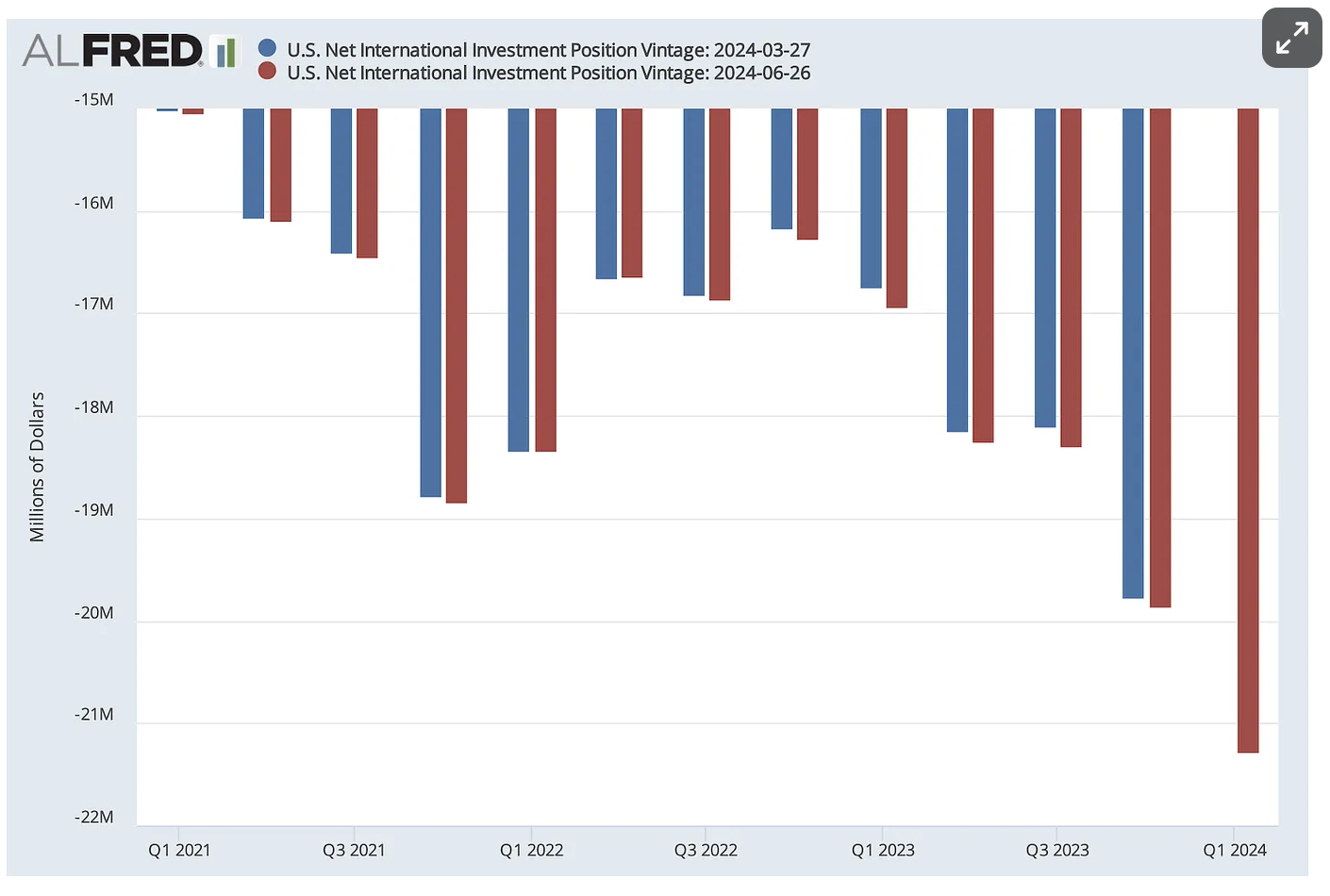

The big difference between the two becomes apparent when you examine something called NIIP, or net international investment position.

Japan has a surplus, which means it owns assets greater than its liabilities.

By contrast, the US has a substantial net international investment deficit, which means the opposite!

This is not a complete surprise. Since Bretton Woods, at the end of WWII, the US has been an importing nation. Its primary export has been US Treasuries, the currency in which it has paid for its imports.

That means that the balance sheets of the two countries look very different.

The Bank of Japan holds over half of Japan's government debt, while the Federal Reserve has more like 30% in the US.

The other important factor is Japan's foreign securities, mainly US treasury debt of around $1.1 trillion. Japan is far and away the biggest foreign holder of US Treasuries.

Japan could sell this and reduce its balance sheet liabilities, generating USD to either pay for imports priced in USD or to defend its currency. The US does not have that luxury.

The US would not want Japan to do that and would go to great lengths to ensure that did not happen. How?

A swap line between the Federal Reserve and the Bank of Japan would work as follows:

The Federal Reserve agrees to exchange USD for Japanese Yen at a specified exchange rate.

The Bank of Japan can then lend this foreign currency to domestic banks that need it or use it to stabilize the Yen by buying Yen with USD.

After a predetermined period, the USD are swapped back at the same exchange rate, with interest paid on the borrowed amount.

The significant advantage of this arrangement is that Japan does not need to sell its US Treasuries to obtain the USD it needs, and the US does not suffer the potentially destabilizing impact of such a sale.

This seems like a magic trick, like borrowing money for a day to take a picture of your bank account to prove your creditworthiness to a creditor and then paying it back the next day.

Central banks are good at that kind of thing. Having the power to print money is a great luxury the US has as the world’s reserve currency.

It doesn’t make me worry less, though.

At a recent crypto conference, Senator Lummis proposed creating a new Bitcoin strategic reserve similar to the Strategic Petroleum Reserve.

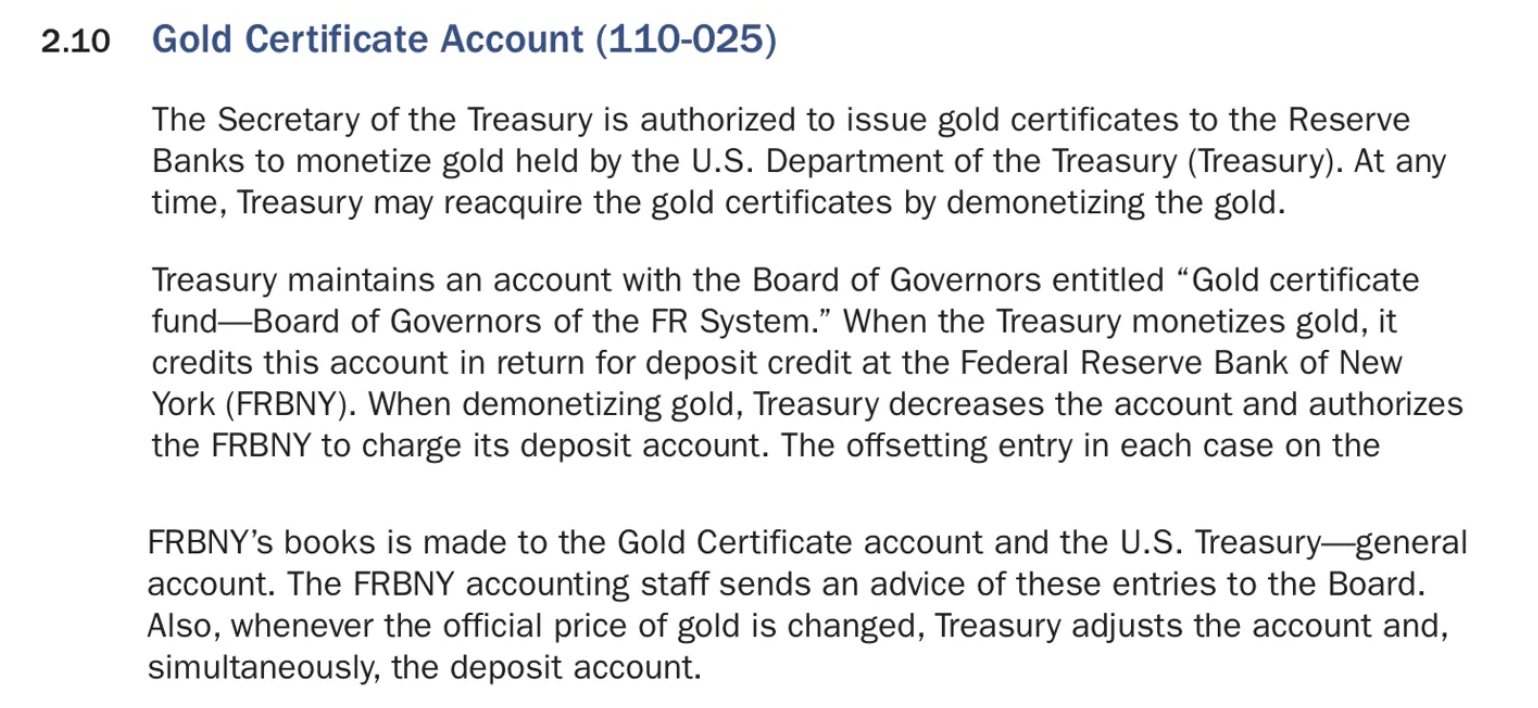

This would, in part, be paid for by using the flexibility outlined below.

Translated into layman’s language, the Federal Reserve Banks would tender all their gold certificates to Janet Yellen.

These certificates currently record the 261 million oz of gold they represent at ~$42/oz, about $11 billion.

Janet Yellen would then issue new gold certificates at the current market value of around $2,500.

This revaluation would generate a cash balance at the Federal Reserve Banks of ~$652 billion.

The Federal Reserve Banks would then remit the difference of $641 billion to the Treasury General Account.

Janet Yellen would then purchase this amount of Bitcoin and set it aside in the hope that it would one day be sufficient to repay a substantial chunk of the Federal Debt.

Magic!

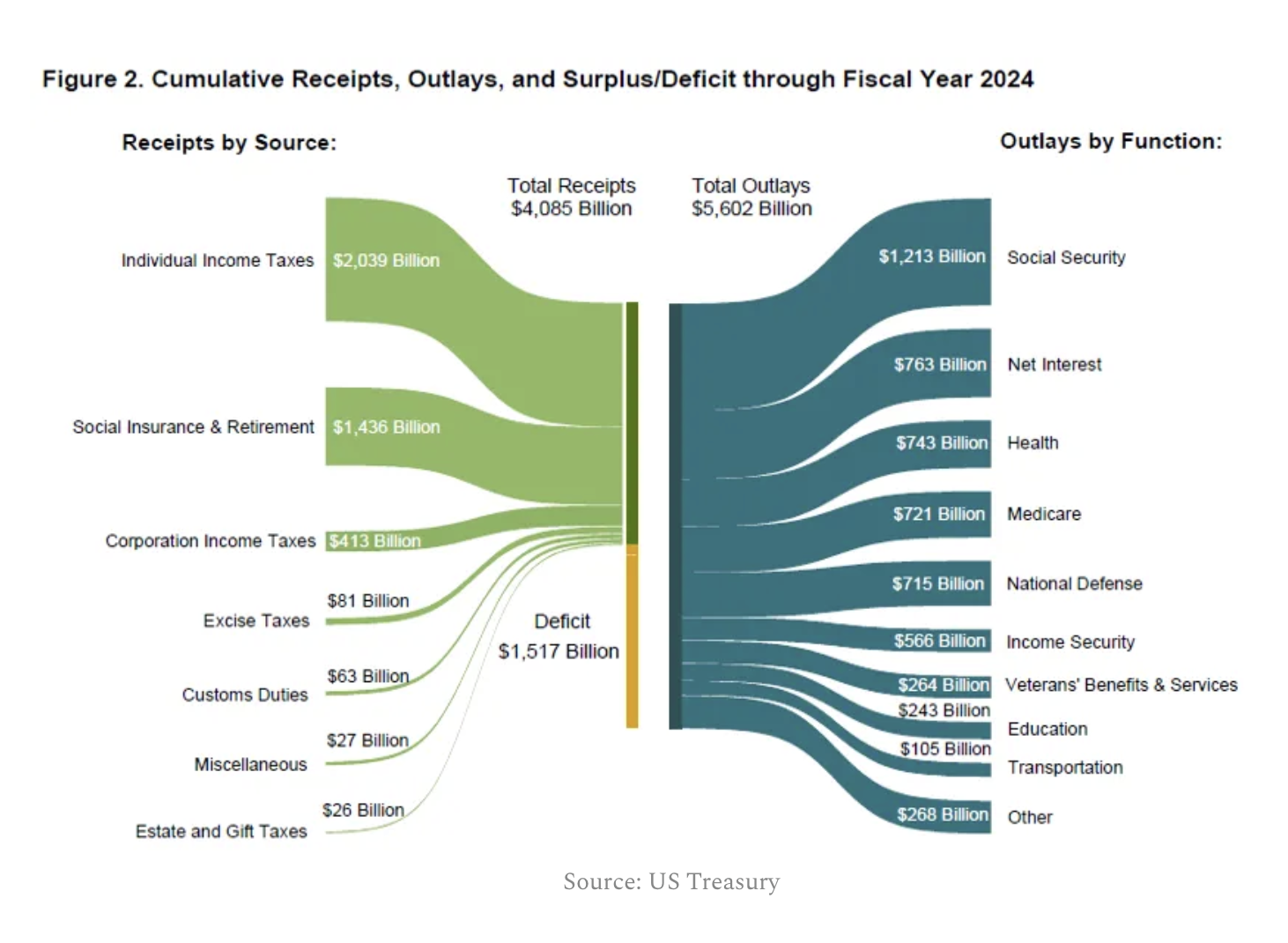

I keep staring at this chart

And I wonder how we will start repaying the debt, magic tricks or otherwise.

Dan Mitchell, a libertarian commentator and recent speaker at the Steamboat Institute conference, correctly points out that we cannot hope to reduce our debt burden as a percentage of GDP unless we slow our spending.

He has some recommendations as to how that might be achieved. They revolve around entitlement reform and include:

Raising the retirement age

Turning social security into a private pension scheme similar to the way many defined-benefit pensions were converted to 401K plans

Both these would be politically unpopular.

He cites Argentina as the latest in a long line of countries that hit troubled times when their debt grew faster than their GDP. The result was Javier Milei's harsh corrective medicine.

Milei was elected with full knowledge of the drastic measures he would take to set the economy on a healthier footing. Riots ensued anyway.

Mitchell’s view—and mine—is that neither Trump nor Harris will likely start administering the fiscal discipline necessary to correct the compounding of our national debt.

It is bordering on being intractable, and I don’t necessarily blame politicians, the Treasury, and the Federal Reserve for kicking the can down the road.

Once upon a time, I had access to a home equity line of credit that allowed me to continue trying to build a business while living somewhere I couldn’t afford.

Eventually, I sold the house and paid it off. The prudent decision would have been to sell the house earlier, but that would not have been a great decision for the family.

When the kids left for college, selling, downsizing, and moving made sense. In other words, there may be good reasons to kick the can down the road.

Absent a productivity miracle that will boost GDP growth above the nominal growth of our debt burden, the debt will keep growing.

Novel measures such as a Strategic Bitcoin Reserve may help, but that is a ‘wishing and hoping’ measure and less of a strategy.

At some point, the US will trend toward becoming Argentina.

Eventually, a political party will have the wisdom and support to change entitlements.

This will be necessary because the chances of reducing defense expenditures are low.

The Federal Reserve will continue to reduce interest rates because the government cannot afford to keep paying interest at current levels.

Neil is the CEO of Dakota Ridge Capital. He is passionate about solving tax, accounting and regulatory problems for institutions that have invested billions of dollars of capital in multiple jurisdictions. Throughout his career, he has successfully assisted a diverse array of organizations, including hedge funds, insurance firms, banks, and large corporations, in raising capital, developing businesses, and securing tax credits. Neil holds a master’s degree in Law from the University of Cambridge.

Leave your comments

Post comment as a guest