The US Election is Over, What's Next for Financial Markets?

The US Election is Over, What's Next for Financial Markets?

Democracy is messy and doesn’t always give you what you want. Your team doesn’t always win, and that’s painful.

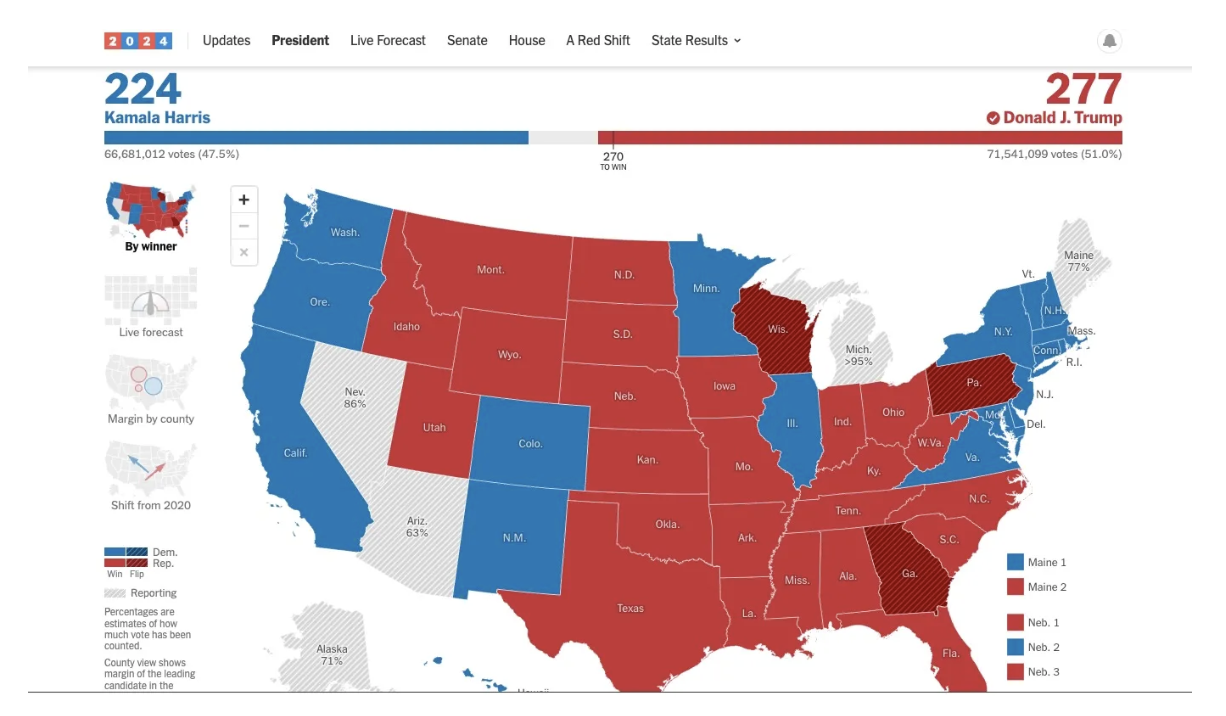

I watched CNN’s John King click through the impressive tech setup to show the results county by county. It gives you a great picture of America.

One of my relatives - he doesn’t live in America - was angry. He said we live in a sh#thole country. I don't see it this way.

America is a great country. When I look at the electoral map and consider the distribution of red and blue, and then I compare the rates of gun ownership.

Top Gun Ownership States (Republican-leaning)

Montana - 65.7% (Republican)

Wyoming - 60.7% (Republican)

West Virginia - 60.6% (Republican)

Idaho - 57.8% (Republican)

Alaska - 57.2% (Republican)

Lowest Gun Ownership States (Democrat-leaning)

Massachusetts - 14.7% (Democrat)

New Jersey - 14.7% (Democrat)

Rhode Island - 14.8% (Democrat)

Hawaii - 14.9% (Democrat)

New York - 19.9% (Democrat)

I understand the founding fathers' wisdom in setting up the Electoral College.

Imagine if the only thing determining the electoral outcomes was the popular vote and the blue state’s population carried the day. There would be a lot of angry gun owners…

I am not saying one should pander to gun owners. I am saying that the interests and motivations of rural and urban dwellers can be very different. If politicians do not pay attention to both, trouble will follow.

I watched the stories of two-plus-hour lines outside polling stations in Nevada, where you still got to vote if you were in line.

I heard stories of election officials contacting voters to check signatures that did not match those on record accurately.

This is a remarkable record of democracy in action, and it gives confidence in the process despite what has been said about it in the last four years.

You (or I) may not like the result, but most Americans have spoken. I can live with that.

I think democracy is alive and well in America.

Now, we will wait to see:

Immigration

What happens with Ukraine-Russia

The Middle East

Inflation

Debt levels

Energy policy

Tariffs

China-Taiwan

We will have a lot of ink spilled on Biden and Harris.

Here’s what I think it will amount to:

Most Americans were angry about inflation (Trump escaped blame for that, even though he bears at least equal responsibility).

A majority of Americans were angry about illegal immigration.

A majority of Americans did not agree Biden had a mandate to allow his progressive wing to throw a party for their pet causes.

What Are The Markets Saying?

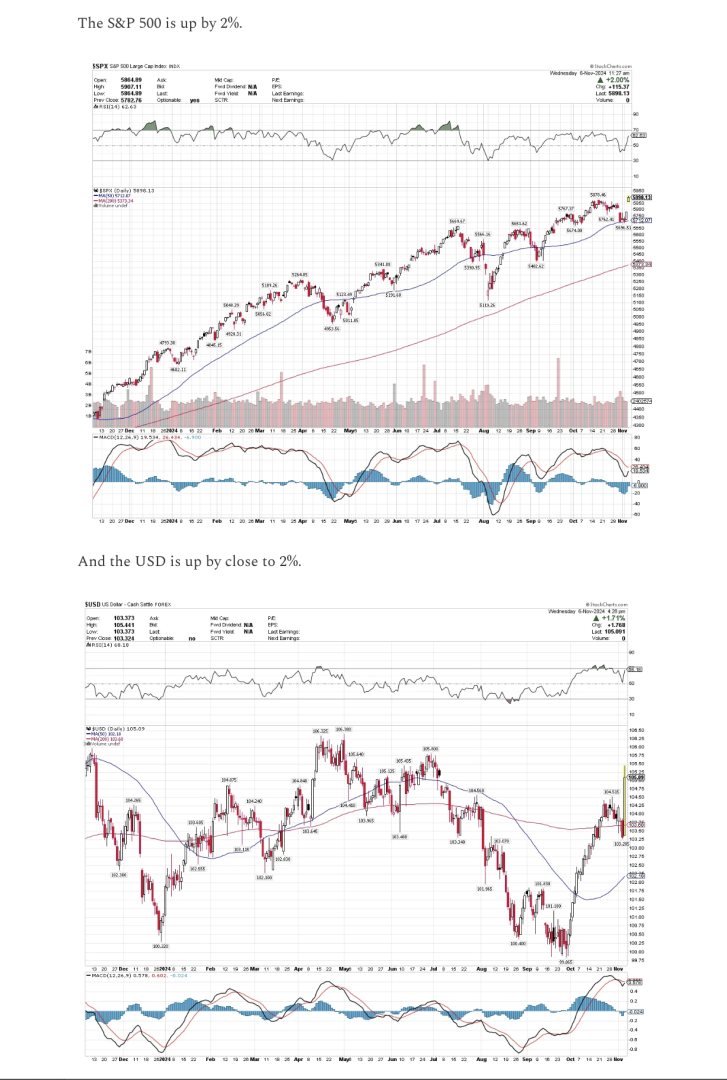

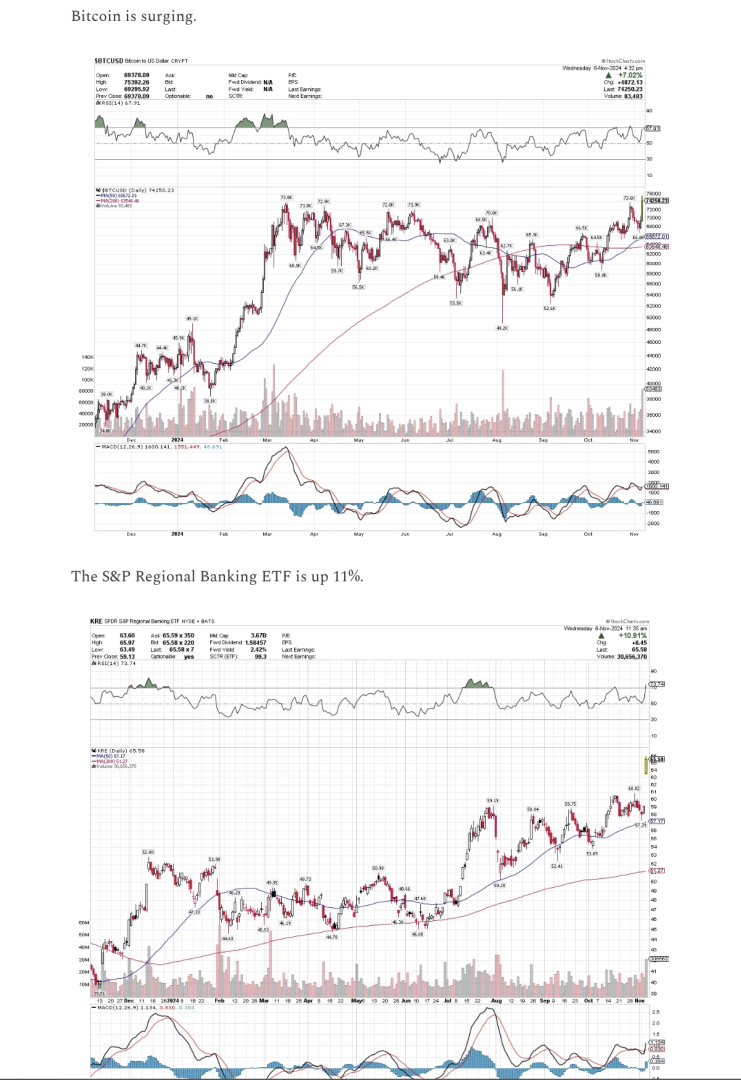

As of the morning after the election, equities love this.

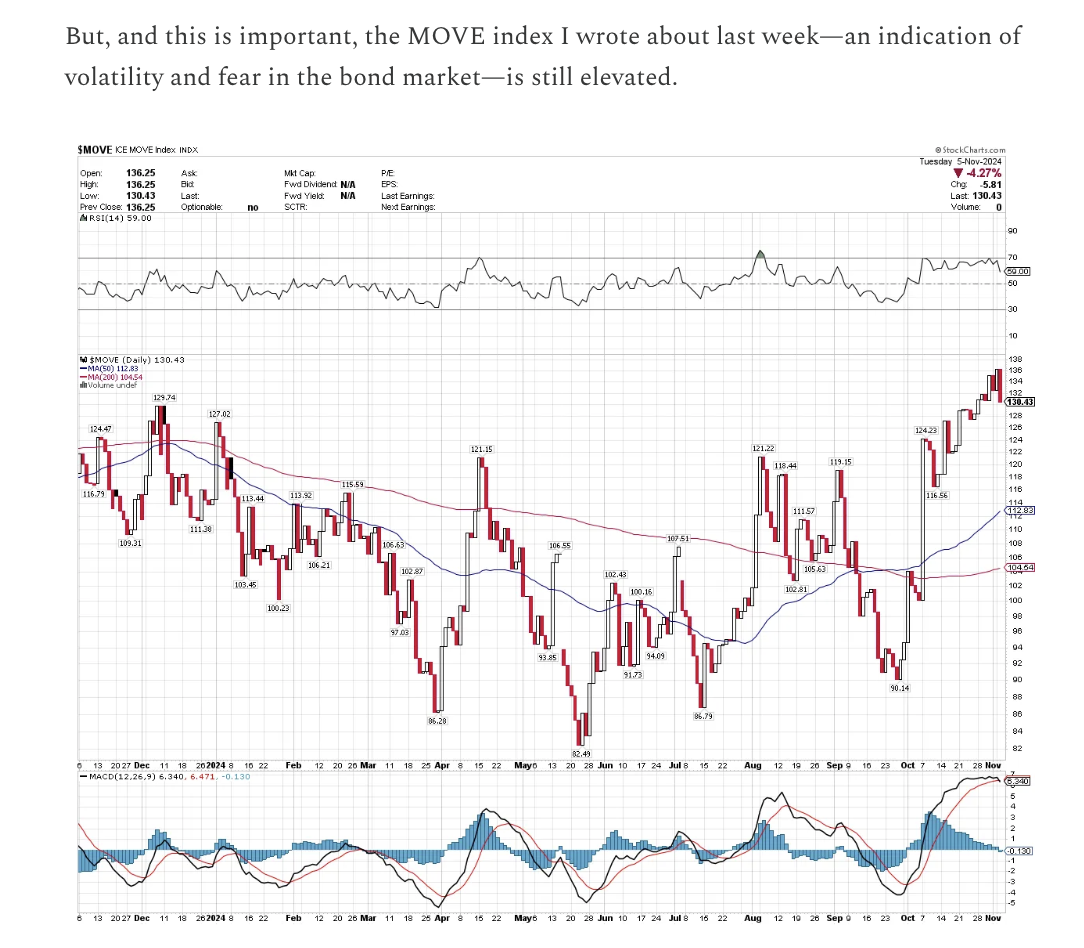

Compared to the VIX, it is off only 5%. Why? The debt and inflation problems are still present, potentially even heightened by a Trump presidency because tariffs will be inflationary.

These are all the elements of the so-called Trump trade.

These movements reflect investors' expectations of Trump's policies, including:

Lower corporate taxes

Deregulation, especially in the financial sector

Protectionist trade policies

Inflationary fiscal policies

Favorable stance towards cryptocurrencies

Apologies for the chart-fest, but the pictures speak louder than the commentary.

What’s On The Horizon For Energy?

I spoke here about whether Trump or Harris had the better energy policy.

Now, we will see what Trump has in mind.

I love the commentary by Robert Bryce on energy markets.

He put together the following predictions regardless of who won.

The vote tally will show, again, the urban-rural divide.

If Trump wins, he won’t repeal the alt-energy subsidies in the IRA. Lobbying resources are vast, and will see to that. Already, 18 GOP congressmen have written a letter to Speaker Johnson to express resistance to the IRA clean energy subsidies. I wrote about that here.

If Trump wins, the LNG export ban will end immediately.

The offshore wind business is doomed.

The EPA’s EV mandates will be scrapped.

Local communities will continue to reject wind and solar installations for health, property values, and land-use reasons.

The reliability of the electric grid will continue to decline.

Regulatory delays and uncertainty in the electric sector will continue.

Scrapping EV mandates, tanking offshore wind, and reauthorizing LNG exports do not constitute a coherent energy policy. Nor does “drill baby drill,” although loosening the regulatory constraints on drilling and exploration will be helpful.

The US desperately needs a coherent energy policy.

The smart folks over at Doomberg wrote a recent article contrasting the German and Chinese energy policies and started with a killer opening paragraph:

Countries that bungle their energy policies can’t have nice things. Among the luxuries that eventually slip out of reach are abundance, good-paying jobs, and an effective military. That leaders in the West fail to understand this—even in the face of a steady parade of evidence that points plainly to the axiomatic nature of the statement—is one of the great mysteries of our time. Energy need not be produced domestically, but unless it can be accessed cheaply and reliably from somewhere, the fate of that economy is sealed and no amount of politicking or bureaucratic reshuffling can overcome that fact.

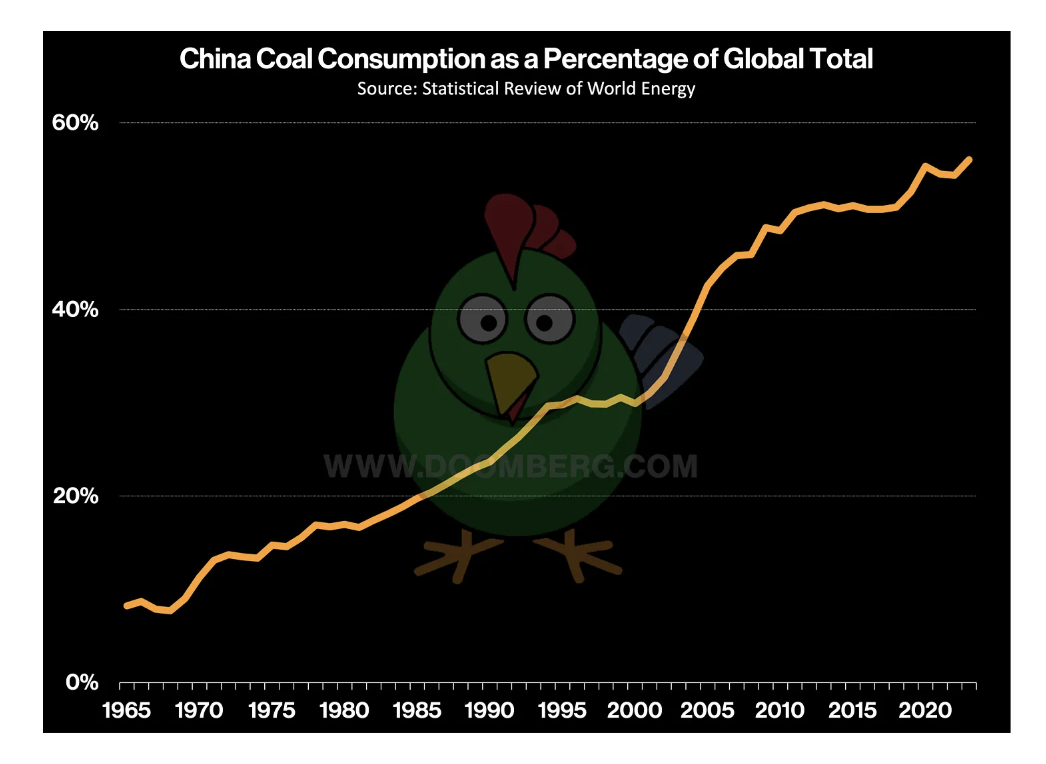

They illustrate how China has turned itself into the world’s cheap manufacturing hub by exploiting its abundant coal reserves.

At the same time, of course, they are rapidly building hydroelectric dams, nuclear power plants, wind farms, and solar farms. They are pursuing an ‘all of the above’ policy.

They have to because they do not have abundant oil and gas reserves.

China has 14% of the world's coal reserves. The US has 22% - 1st in the world.

China consumes 3.5 billion tons per year - nearly 5x the amount the US consumes.

Donald Trump does not worship at the Church of Renewable Energy and is skeptical about the religion of climate change. His policy is more likely to follow an ‘all of the above’ approach, but we have yet to see any policy outlines beyond ‘drill, baby drill.’

How Optimistic Am I About the Trump Administration?

Tough question today because I was not on team Trump.

However, as I said, the American electorate has expressed a very clear wish and , as I said above, I can live with that. We all have to.

So, what will this mean, and how constrained will his promises be? It depends. We know the Republicans control the Senate. The House is still to be decided.

It seems likely that either side will have slim control, and legislative progress will involve compromise. Besides certain legislation on budget matters, the Senate requires 60 votes to pass legislation.

In his first term, Trump made progress on some critical issues, including the renegotiation of NAFTA, which cemented our trading relationships with partners in the North and South.

He had a stronger stance on immigration - that is likely to return. Not a bad thing (spoken as an immigrant who spent a long time acquiring a green card and then a passport).

I am going to punt on Ukraine-Russia and the Middle East, other than to say that Trump appears to care much less than Democratic leaders about alliances. He is much more transactional.

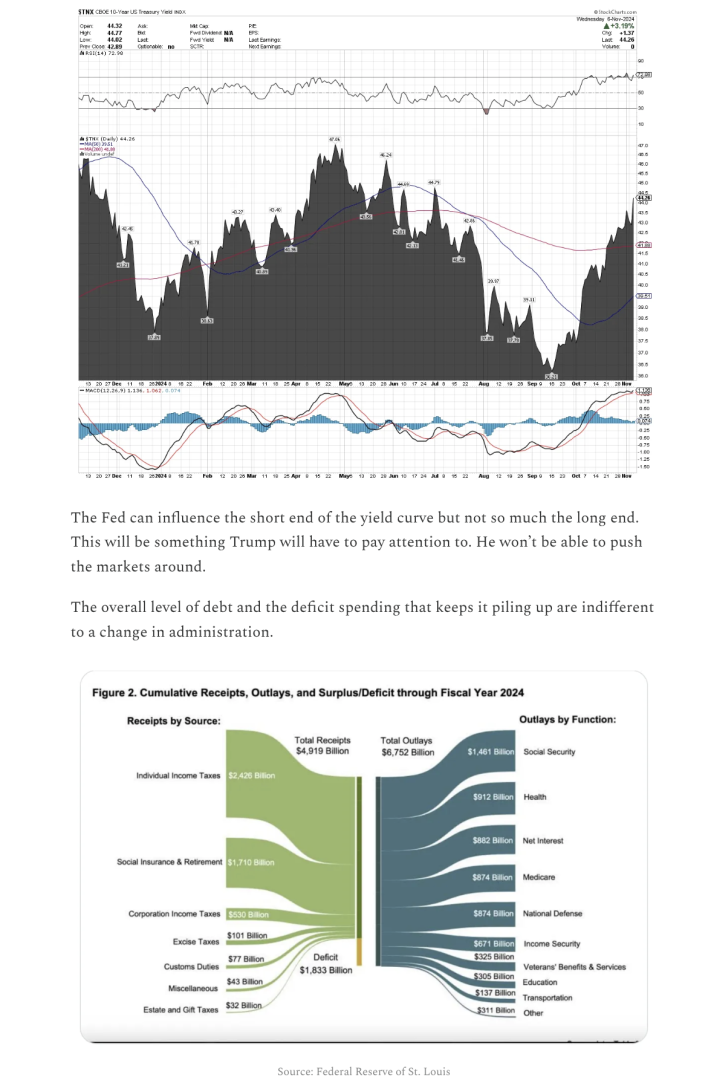

He will be more constrained than he might like regarding the economy. When the Federal Reserve lowered the Fed Funds rate by 50bps on September 18th, the rate on the ten-year Treasury went up.

The so-called bond vigilantes are beginning to make their presence felt.

Elon Musk said he could cut $2 trillion of Federal spending annually, but he did not specify from where. The categories above show where the money is spent.

Takeaways

The election is over, and the result is clear - a huge relief compared to uncertainty.

The financial markets hate uncertainty and seem overjoyed at the election result.

The key to any progress in the economy is energy.

Energy is the miracle that can fuel AI, and AI is the miracle that can turbocharge productivity.

If Trump gets energy policy right, he will have done us all a huge favor.

We can obsess and stress about the cultural aspects of a Trump presidency - I am sure the media will do that - but I prefer to focus on the economy.

Neil Winward

Taxation Expert

Neil is the CEO of Dakota Ridge Capital. He is passionate about solving tax, accounting and regulatory problems for institutions that have invested billions of dollars of capital in multiple jurisdictions. Throughout his career, he has successfully assisted a diverse array of organizations, including hedge funds, insurance firms, banks, and large corporations, in raising capital, developing businesses, and securing tax credits. Neil holds a master’s degree in Law from the University of Cambridge.

Trending

1 Revenue-Based Financing: A Modern Funding Solution for Businesses

Daniel Hall2 The US Election is Over, What's Next for Financial Markets?

Neil Winward3 How To Know You’re Eligible for a VA Construction Loan

Daniel Hall4 Navigating Financial Challenges: Strategies for Small Businesses

Daniel Hall5 Top Small Business Loans to Fuel Your Growth in 2024

Daniel Hall