Comments

- No comments found

Artificial Intelligence (AI) has been transforming various industries and sectors, and the insurance industry is no different.

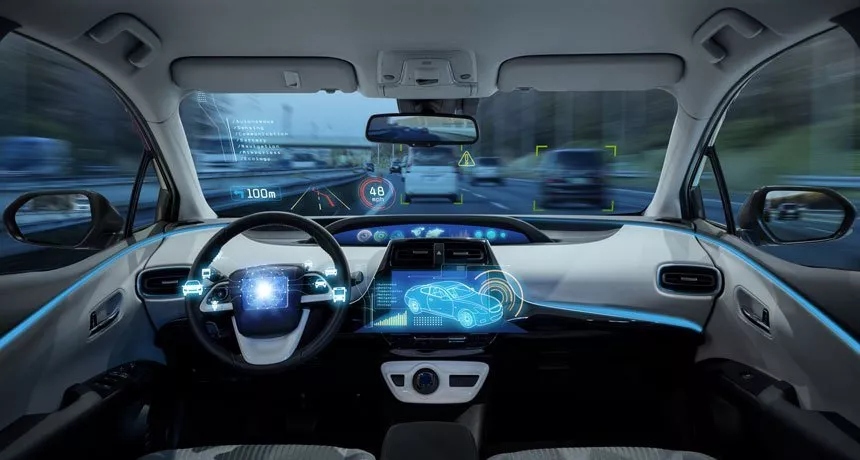

Auto insurance, in particular, is set to experience significant changes due to the integration of AI. Insurance companies are already using AI to automate claims processing, fraud detection, and risk assessment. However, AI's potential goes beyond these applications and could revolutionize the entire auto insurance industry.

One of the most significant ways AI could transform auto insurance is through the use of telematics. Telematics involves the use of sensors and GPS technology to track a driver's behavior, such as speed, braking, and acceleration. This data can be used to assess the driver's risk level and determine their insurance premiums. With AI, this data can be analyzed in real-time, allowing insurers to adjust premiums based on the driver's behavior. This could lead to more personalized insurance policies that are tailored to each driver's specific needs and driving habits.

Another way AI could transform auto insurance is through the use of predictive analytics. By analyzing vast amounts of data, AI can identify patterns and predict future events with a high degree of accuracy. In the case of auto insurance, predictive analytics could be used to identify high-risk drivers and take proactive measures to reduce accidents and claims. For example, insurers could use AI to alert drivers when they are approaching a dangerous intersection or to recommend safer routes based on traffic patterns. Overall, AI has the potential to make auto insurance more efficient, personalized, and cost-effective for both insurers and policyholders.

Artificial Intelligence (AI) has the potential to revolutionize the auto insurance industry by enhancing the accuracy of premium calculations. With the help of AI, insurance companies can analyze vast amounts of data related to a driver's behavior, including their driving history, age, gender, location, and vehicle information, to determine their risk level accurately.

AI algorithms can also take into account more subtle factors, such as the weather, traffic, and time of day, to provide a more comprehensive risk assessment. By using this data, insurance companies can offer personalized policies that reflect the driver's specific risk profile, leading to more accurate premium calculations.

AI can also play a critical role in predicting personal injury risks. By analyzing data related to accidents, including the location, weather, and road conditions, AI algorithms can identify patterns and make predictions about the likelihood of personal injury in a given situation.

This information can help insurance companies design policies that provide adequate coverage for personal injury risks. For example, AI can help insurance companies identify high-risk areas and adjust their coverage accordingly. Additionally, AI can help insurers identify drivers who are at higher risk of causing accidents and offer them more comprehensive policies.

In conclusion, AI has the potential to transform the auto insurance industry by enhancing the accuracy of premium calculations and predicting personal injury risks. By leveraging AI technology, insurance companies can offer more personalized policies that reflect the driver's specific risk profile, leading to more accurate premium calculations and better coverage for personal injury risks.

Artificial intelligence is transforming the auto insurance industry in various ways, including claims processing. With AI-powered claims processing, insurers can streamline the claims handling process, reduce costs, and improve customer satisfaction.

One of the most significant benefits of AI in claims processing is automated damage evaluation. AI algorithms can analyze images of damaged vehicles and assess the extent of the damage accurately. This helps insurers to expedite the claims process and reduce the time it takes to settle claims.

AI-powered damage evaluation can also reduce the potential for human error, which can occur when claims adjusters rely on their subjective judgment to assess damage. This can help ensure that policyholders receive fair and accurate compensation for their claims.

AI can also play a crucial role in detecting and preventing fraudulent claims. Insurance fraud is a significant problem in the auto insurance industry, and it can cost insurers billions of dollars each year. AI algorithms can analyze data from various sources, including social media, to identify patterns that may indicate fraudulent activity.

By detecting fraudulent claims early, insurers can save money and reduce the risk of paying out on illegitimate claims. This can help keep premiums low for policyholders, which can improve customer satisfaction.

Overall, AI-driven claims processing has the potential to transform the auto insurance industry. By automating damage evaluation and detecting fraudulent claims, insurers can reduce costs, improve efficiency, and provide better service to their customers.

One of the most significant benefits of leveraging artificial intelligence (AI) in auto insurance is the ability to offer tailored policies to customers. By analyzing data from various sources, including driving behavior, vehicle make and model, and personal information, AI algorithms can create personalized policies that reflect individual risk profiles.

For instance, a driver who only uses their car for short distances and at low speeds may be offered a lower premium than someone who frequently drives long distances at high speeds. Similarly, a driver who owns a newer, safer vehicle may be offered a lower premium than someone with an older, less safe model.

By offering tailored policies, insurance companies can provide customers with a more personalized experience, which can lead to increased customer satisfaction and retention.

Another way that AI can transform the customer experience in auto insurance is through real-time customer support. By leveraging chatbots and other AI-powered tools, insurance companies can offer instant support to customers whenever they need it.

For example, if a customer is involved in an accident, they can use a chatbot to report the incident and receive immediate assistance. The chatbot can guide the customer through the claims process and even provide real-time updates on the status of their claim.

By offering real-time support, insurance companies can improve the overall customer experience and reduce the time and effort required to resolve issues. This can lead to increased customer satisfaction and loyalty.

In conclusion, AI has the potential to transform the customer experience in auto insurance by offering tailored policies and real-time support. By leveraging these capabilities, insurance companies can provide customers with a more personalized and efficient experience, which can lead to increased satisfaction and retention.

In conclusion, auto insurance companies must prioritize data security, privacy, fairness, and transparency as they incorporate AI into their operations. By doing so, they can provide better services to their customers while avoiding potential ethical and legal pitfalls.

Leave your comments

Post comment as a guest