Some Economics for Martin Luther King Day

Some Economics for Martin Luther King Day

On November 2, 1983, President Ronald Reagan signed a law establishing a federal holiday for the birthday of Martin Luther King Jr., to be celebrated each year on the third Monday in January. As the legislation that passed Congress said: "such holiday should serve as a time for Americans to reflect on the principles of racial equality and nonviolent social change espoused by Martin Luther King, Jr.." Of course, the case for racial equality stands fundamentally upon principles of justice, not economics. But here are a few economics-related thoughts for the day clipped from 2018 posts at this article, with more detail and commentary at the links:

1) "What Causes Inequality to Erupt Into Riots? Revisiting the Kerner Commission" (September 6, 2018)

"The Kerner report was the final report of a commission appointed by the U.S. President Lyndon B. Johnson on July 28, 1967, as a response to preceding and ongoing racial riots across many urban cities, including Los Angeles, Chicago, Detroit, and Newark. These riots largely took place in African American neighborhoods, then commonly called ghettos. On February 29, 1968, seven months after the commission was formed, it issued its final report. The report was an instant success, selling more than two million copies. ... The Kerner report documents 164 civil disorders that occurred in 128 cities across the forty-eight continental states and the District of Columbia in 1967 (1968, 65). Other reports indicate a total of 957 riots in 133 cities from 1963 until 1968, a particular explosion of violence following the assassination of King in April 1968 (Olzak 2015)."

The September 2018 issue of the Russell Sage Foundation Journal of the Social Sciences includes a 10-paper symposium from a range of social scientists concerning "The Fiftieth Anniversary of the Kerner Commission Report." The introductory essay by Susan T. Gooden and Samuel L. Myers Jr., "The Kerner Commission Report Fifty Years Later: Revisiting the American Dream" (pp. 1–17) does an excellent job of setting the historical context and contemporary reactions to the report, along with offering some comparisons that I at least had not seen before how hard it is to explain why some cities experienced riots and others did not.

The opening paragraph above is quoted from the Gooden/Myers paper. As they point out, perhaps the most commonly repeated comment from the report was that it baldly named white racism as an underlying cause. They quote the Kerner report: “What white Americans have never fully understood—but what the Negro can never forget—is that white society is deeply implicated in the ghetto. White institutions created it, white institutions maintain it, and white society condones it.” Although the Kerner report was widely disseminated, it was not popular. As Gooden and Myers report:

"President Johnson was enormously displeased with the report, which in his view grossly ignored his Great Society efforts. The report also received considerable backlash from many whites and conservatives for its identification of attitudes and racism of whites as a cause of the riots. `So Johnson ignored the report. He refused to formally receive the publication in front of reporters. He didn’t talk about the Kerner Commission report when asked by the media,' and he refused to sign thank-you letters for the commissioners (Zelizer 2016, xxxii–xxxiii)."

2) "Black-White Disparities: 50 Years After the Kerner Commission" (February 27, 2018)

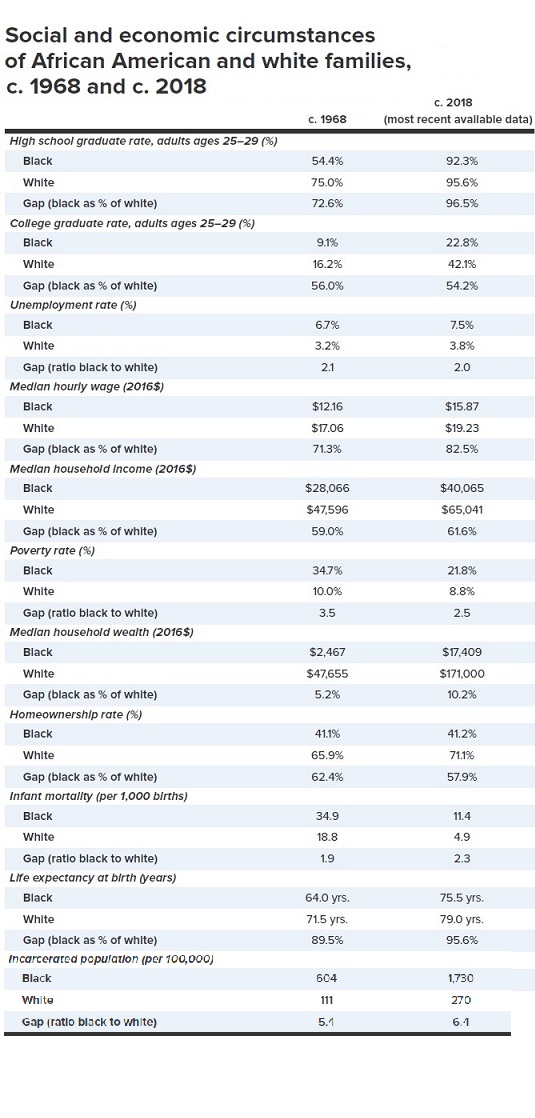

Janelle Jones, John Schmitt, and Valerie Wilson offer a useful starting point in the short report, "50 years after the Kerner Commission: African Americans are better off in many ways but are still disadvantaged by racial inequality," from the Economic Policy Institute (February 26, 2018).

3) "Black/White Racial Inequality: A Place-Based Look" (October 5, 2018)

The black population is not equally distributed across the United States: not equally across regions of the country, nor within metropolitan areas. This unequal distribution is in substantial part a result of historical events and policy decisions, many of them rooted in racism. As a result, policies that affect certain regions of the country more than others, or certain parts of metropolitan areas more than others, will inevitably have disparate racial effects. Bradley L. Hardy, Trevon D. Logan, and John Parman lay out the evidence and arguments for these and related claims in "The Historical Role of Race and Policy for Regional Inequality," which appears as a chapter in Place-Based Policies for Shared Economic Growth, edited by Jay Shambaugh and Ryan Nunn (Hamilton Project at the Brookings Institution, September 2018). As one example:

"As of 1880, 90 percent of the black population still lived in the South and 87 percent of the black population lived in a rural area. In contrast, only 24 percent of the white population lived in the South, and 72 percent of the white population lived in rural areas. This meant that black individuals were disproportionately affected by constraints on economic opportunity in the rural South. Over the second half of the 19th century, incomes in the South and the North diverged significantly, with average income in the South only half of the national average by 1900 ,,, The destruction caused by the Civil War and the emergence of northern manufacturing while the southern economy remained predominantly agricultural contributed to these trends. The black population therefore found itself in a region with far less economic opportunity than the rest of the nation."

As the authors also note, the lack of opportunity for rural southern blacks was reinforced by racism by individuals, employers, social institutions and government, which affected education, labor markets, and political participation. This lack of opportunity stirred what is called the "Great Migration" of blacks from the American south to northern cities, a pattern that lasted into the 1960s and which helped to reduce black-white gaps in income and other areas. But when blacks arrived in northern cities, they faced patterns of rising segregation by race. In many ways, the geographic location patterns of the current black population was heavily shaped over the last century-and-a-half by those policies. Moreover, the geographic location patterns of the black population are closely linked to the continuing inequalities of outcomes experienced by the black population.

4) "Black-White Income and Wealth Gaps" (July 2, 2018)

William Darity Jr., Darrick Hamilton, Mark Paul, Alan Aja, Anne Price, Antonio Moore, and Caterina Chiopris discuss "What We Get Wrong About Closing the Racial Wealth Gap" (April 2018, Samuel DuBois Cook Center on Social Equity at Duke University). The paper is written in the form of myths about the black-white wealth gap, then followed by evidence.

Myth 1: Greater educational attainment or more work effort on the part of blacks will close the racial wealth gap. ...

At every level of educational attainment, black families’ median wealth is substantially lower than their white counterparts. White households with a bachelor’s degree or post-graduate education (such as with a Ph.D., MD, and JD) are more than three times as wealthy as black households with the same degree attainment. Moreover, on average, a black household with a college-educated head has less wealth than a white family whose head did not even obtain a high school diploma. It takes a post-graduate education for a black family to have comparable levels of wealth to a white household with some college education or an associate degree ...

Myth 2: The racial homeownership gap is the “driver” of the racial wealth gap. ...

The data indicates that white households who are not home-owners hold 31-times more wealth than black households that do not. Among households that own a home, white households have nearly $140,000 more in net worth than comparable black households. ...

Myth 3: Buying and banking black will close the racial wealth gap. ...

Black-owned banks also are miniscule in the context of the general scale of American banking. The largest five black owned banks recently were estimated to have assets totaling $2.3 billion, while J.P. Morgan alone had an estimated $2 trillion in assets.

Myth 4: Black people saving more will close the racial wealth gap. ...

[T]here is no evidence that black Americans have a lower savings rate than white Americans once household income is taken into account ...

Myth 5: Greater financial literacy will close the racial wealth gap...

Meager economic circumstances—not poor decision making or deficient knowledge—constrain choices and leave asset-poor borrowers with little to no other option but to use predatory and abusive alternative financial services. A negligible level of economic resources readily explains why blacks, specifically, use more predatory financial institutions. ...

Myth 6: Entrepreneurship will close the racial wealth gap. ....

Blacks are far less likely to own a business, and for blacks that do own a business they have far less equity. ... In reality the data paints a daunting picture for diversity in entrepreneurship. According to the U.S. Census Bureau’s Survey of Business Owners (SBO), which is conducted every five years, over 90 percent of Latino and black firms do not have even one employee other than the owner. ... No amount of tutorials or online courses from wealth experts can change the reality of the racialized advantages and disadvantages that undergird entrepreneurship in America. ...

Myth 7: Emulating successful minorities will close the racial wealth gap. ...

In short, so-called “successful” immigrant groups actually retrieve a comparable class position as the one they held in their country of origin. Their pre-migration capital, whether embodied in their education and training or their financial resources, is critical in determining their outcomes in the United States. ... To suggest that blacks and racialized Latino, and Native Americans should emulate other supposedly successful “minority” groups perpetuates the false narrative that their asset poverty is due to a lack of hard work, effort, or ambition. ...

Myth 8: Improved “soft skills” and “personal responsibility” will close the racial wealth gap.

Black men already are largely located in service sector jobs that require, or depend, on “soft-skills.” It is not “soft skills” requirements that distinguish black and white male sites of employment. It is relatively lower pay in the jobs held by the former and relatively higher pay in jobs held by the latter.

Myth 9: The growing numbers of black celebrities prove the racial wealth gap is closing. ...

Unfortunately, from “The Cosby Show” to Michael Jackson’s multi-platinum albums to Will Smith’s meteoric rise to the present day mega couple Jay-Z and Beyoncé, black celebrity has masked black poverty, rather than contributed to closing the racial wealth gap. ... Despite recently released 2016 Federal Reserve data showing that the median black family has a net worth of about $17,600, while the median white family has a net worth closer to $170,000 (Jan 2017), black life has come to be seen through the lens of radically exceptional cases, rather than typical ones.

Myth 10: Black family disorganization is a cause of the racial wealth gap. ...

However, marriage does little to help equalize wealth among white and black women with a college degree. For example, married white women without a bachelor’s degree are in households where they have more than two and a half times the wealth of married black women with a degree. Racial wealth disparities widen among married women with a bachelor’s degree; married white women are in households that have more than five times the amount of wealth as their black counterparts. White households with a single white parent have more than two times the net worth of two parent black households ...

Raj Chetty, Nathaniel Hendren, Maggie R. Jones, and Sonya R. Porter have written, "Race and Economic Opportunity in the United States:An Intergenerational Perspective" (March 2018, also available as NBER Working Paper #24441). The authors have written a nice readable summary of main findings for the VoxEU website (June 27, 2018). Here are the main findings:

Finding #1: Hispanic Americans are moving up in the income distribution across generations, while Black Americans and American Indians are not. ... In contrast, black and American Indian children have substantially lower rates of upward mobility than the other racial groups. For example, black children born to parents in the bottom household income quintile have a 2.5% chance of rising to the top quintile of household income, compared with 10.6% for whites.

Finding #2: The black–white income gap is entirely driven by differences in men’s, not women’s, outcomes. ...

Finding #3: Differences in family characteristics – parental marriage rates, education, wealth – and differences in ability explain very little of the black–white gap. ...

Finding #4: In 99% of neighbourhoods in the United States, black boys earn less in adulthood than white boys who grow up in families with comparable income.

Finding #5: Both black and white boys have better outcomes in low-poverty areas, but black-white gaps are bigger in such neighbourhoods. ...

Finding #6: Within low-poverty areas, black–white gaps are smallest in places with low levels of racial bias among whites and high rates of father presence among blacks. ...

Finding #7: The black–white gap is not immutable: black boys who move to better neighbourhoods as children have significantly better outcomes.

5) "Moral Licensing: When Doing Good Frees You to do Bad" (August 17, 2018)

"Moral licensing" is a term from the behavioral psychology literature. Daniel Effron of the London Business School, who has done some of the research in this area, describes it this way: "[T]he ability to point to evidence of past virtue can ironically make people more willing to act less-than-virtuously." Or as the title of one article puts it "being good frees us to be bad." Some of the examples in this literature describe how those who have participated in an action that seems virtuous then become more prone to display racist attitudes.

One study done back in 2008 asked whether a white person or a black person would be more qualified for a certain job. They were also asked about whether they favored Barack Obama for president--but some were asked before the question about job suitability and some were asked after. "[T]he opportunity to endorse Barack Obama made individuals subsequently more likely to favor Whites over Blacks." The results are in Effron, D.A., Cameron, J.S., Monin, B., Endorsing Obama Licenses Favoring Whites, Journal of Experimental Social Psychology (2009).

Sometimes just anticipating the prospect of doing good in the future can free you you up to do bad in the present. Jessica Cascio and E. Ashby Plant study "Prospective moral licensing: Does anticipating doing good later allow you to be bad now?" Journal of Experimental Social Psychology (2015, 56, pp. 110-116):

"Across four studies we explored whether anticipating engaging in a moral behavior in the future (e.g., taking part in a fundraiser or donating blood) leads people to make a racially biased decision (Studies 1 and 2) or espouse racially biased attitudes (Studies 3 and 4) in the present. Participants who anticipated performing a moral action in the future displayed more racial bias than control participants. ... These results demonstrate that anticipating a future moral act licenses people to behave immorally now and indicate that perceptions of morality encompass a wide variety of concepts, including past as well as anticipated future behavior."

A version of this article first appeared here.

Timothy Taylor

Global Economy Expert

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Trending

1 Are Theme Park Rides a Giffen Good?

Timothy Taylor2 UK Government Unveils New AI Assurance Platform to Boost Trust and Economic Growth

Fabrice Beaux3 London Internet Exchange Appoints Jennifer Holmes as New CEO

Fabrice Beaux4 Daylight Savings Time: Origins, Impacts, and Ongoing Debate

Anas Bouargane5 The Inflationists’ Narrative Is Crumbling

Daniel Lacalle