Comments

- No comments found

From energy breakthroughs to interest rate shifts, the forces shaping the current financial climate are both multifaceted and surprising.

While certain indicators suggest a recession might be looming, other factors, like government spending and a surge in consumer activity—especially from the Baby Boomer generation—are propping up the economy in unexpected ways.

There is so much going on in this market, it’s enough to make your head spin, or, if you’re anything like me, make you wake up at 3:30 AM and start processing.

Here’s what we are going to look at:

The great news on energy

The importance of the interest rates market and it’s telling us

The ‘boomer YOLO’ effect

Why things are looking good when it seems they should be looking bad

The US is starting to figure out the power of nuclear power.

The FT highlighted how the world’s biggest banks - previously hesitant to move on nuclear power financing, fearing public backlash - now feel they can move, as a group, to support the initiative highlighted by COP28.

It's a similar story with Microsoft entering into a contract with Constellation Energy to support the re-opening of Three Mile Island and with Oracle announcing its own nuclear-dependent data center.

And, for the energy source that is most abundant and can be deployed quickest at scale.

There is a limit to the amount of gas that can be flared. Often co-produced alongside fracking for oil, if the pipeline capacity is available, more gas will be produced.

In the last two days, I have had unrelated conversations with operators who are considering using the incentives under the Inflation Reduction Act to add methane capture equipment and geothermal equipment to oil and gas wells, both to take advantage of available tax credits but also to source cheap electricity for their operations.

All of the above are excellent news for an economy in desperate need of energy.

It has been just over a week since the Federal Reserve announced the reduction of the Fed Funds rate from 5.25% to 4.75%.

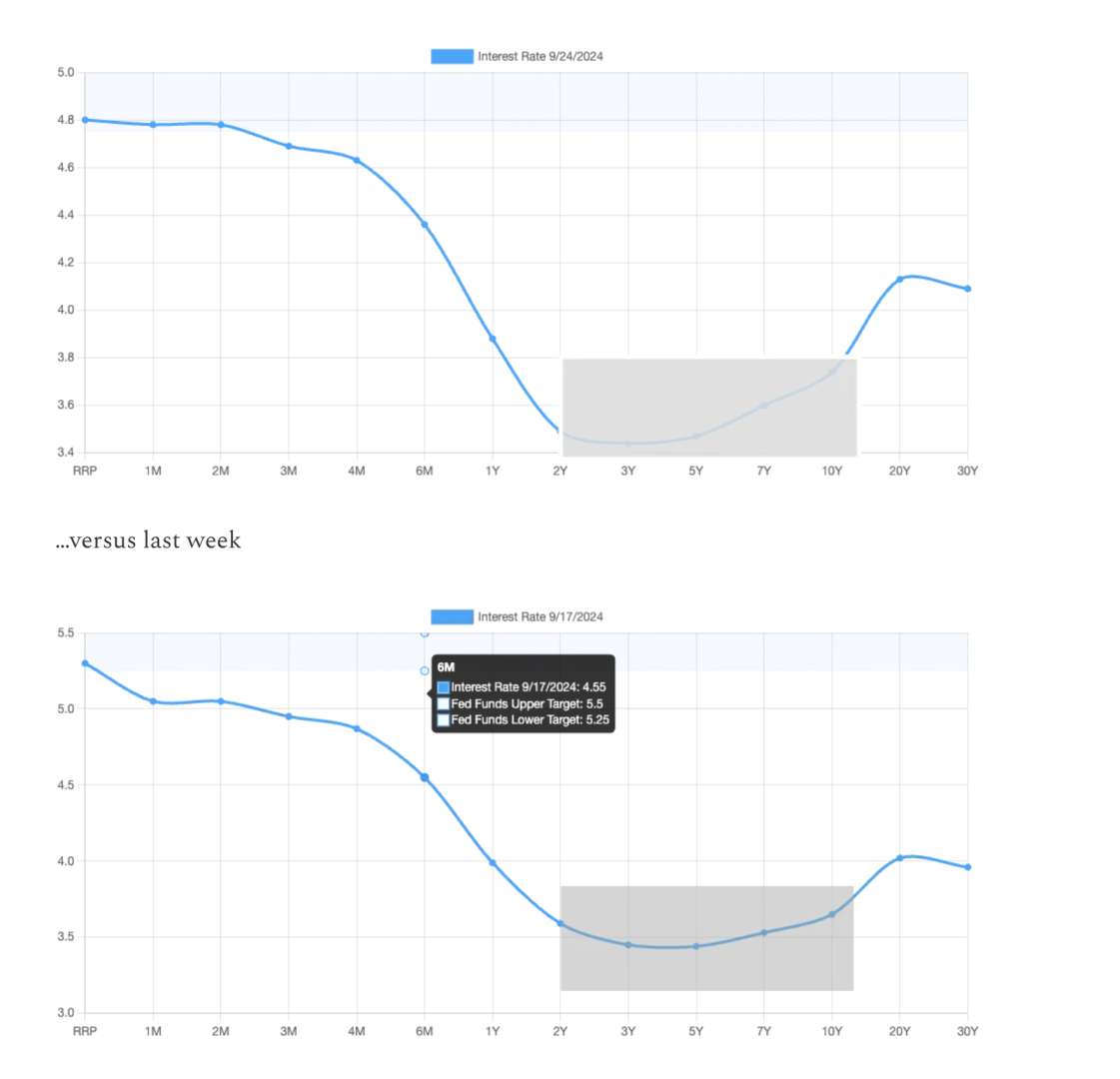

The market has loved it. The consensus view is that Jay Powell is close to Last week, I posted a few snapshots of the evolving yield curve picture. Here is this week:

Looking at the grey boxes, the yield curve from 2-10 years - possibly the most closely watched part of the overall yield curve - has steepened noticeably. This is a more normal state, indicating investors’ expectations of being paid more for taking longer-term risks.

The very short-term end of the curve is still elevated, reflecting the large number of T-Bills still outstanding at rates struck before the Fed reduced the rate by 50 bps.

The 2-10 spread reflects market expectations of the Fed’s future course of action.

Broad expectations are for another 50 bps of cuts in 2024 and an additional 100 bps during 2025, bringing the Fed Funds rate to 3.25% by the end of 2025.

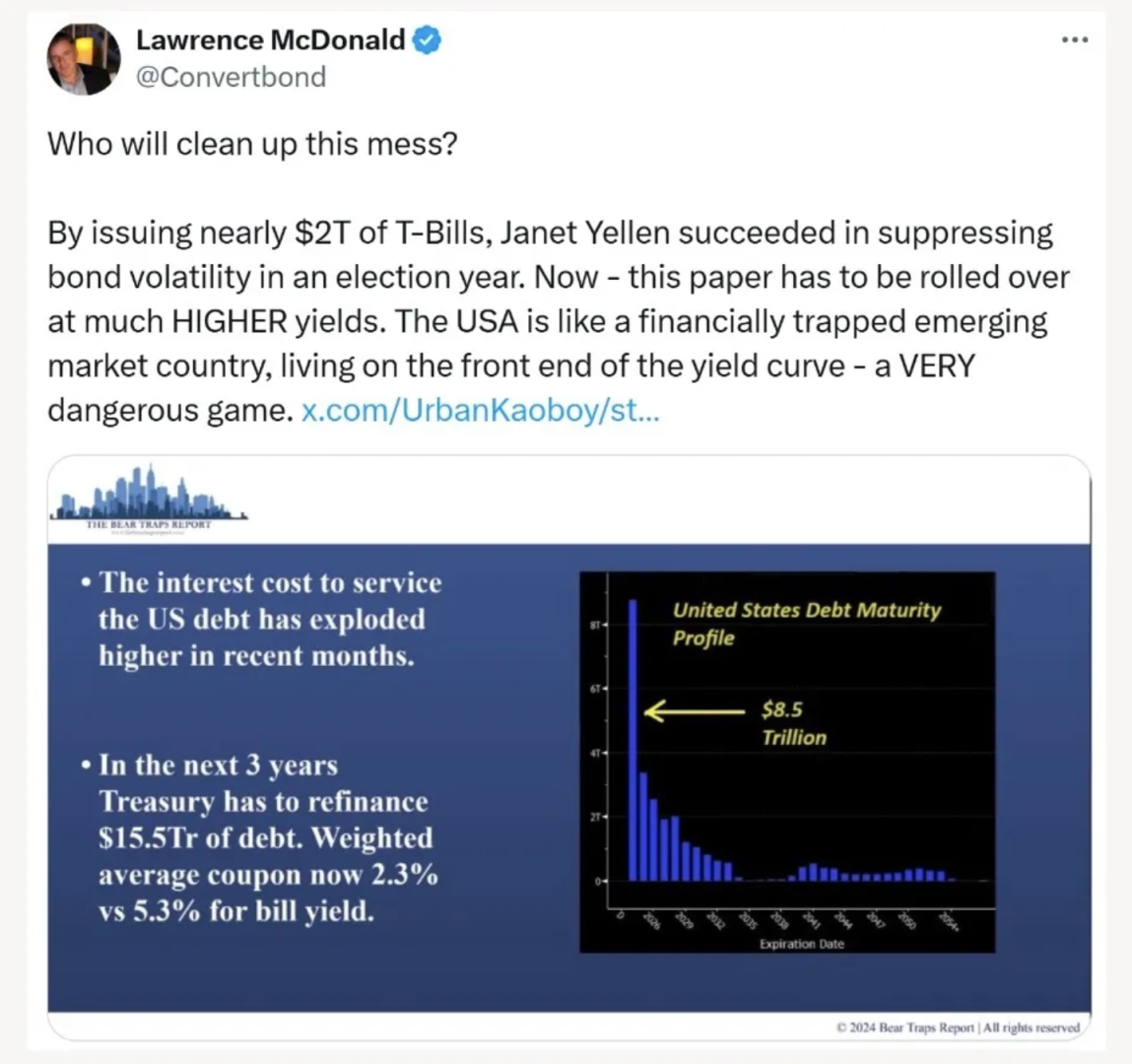

As Larry MacDonald points out, Janet Yellen (assuming she keeps her job after the election) has $15.5T of debt to refinance over the next three years. Given the size of the debt to be refinanced, Yellen needs rates as low as possible to prevent the deficit from surging higher from increased interest expense.

If she continues to focus on issuance at the short end in T-Bills, she needs rates to come down aggressively. If she issues at the long end, she needs rates to come down by about 100 bps, but, more importantly, she needs to be comfortable that there is sufficient liquidity in the long end to accomplish her goals.

Powell is helping because the more he reduces the Fed Funds rate, the more he pushes investors who have become accustomed to higher-yielding, short-term deposits into taking longer-term risk.

If you liked the 5.25% yield on your money market fund, too bad. You will have to look elsewhere.

Where will you go? Stocks? Maybe. But, while now is a good time to be in the market, it’s not clear that it is a good time to enter the market.

How about longer-term government bonds? Maybe. Buying 5-10-year bonds at these levels may be good if rates continue their downward trend. Good in two ways: if you like the yield, hold to maturity. Or, if rates come down, you can sell the bonds for a gain.

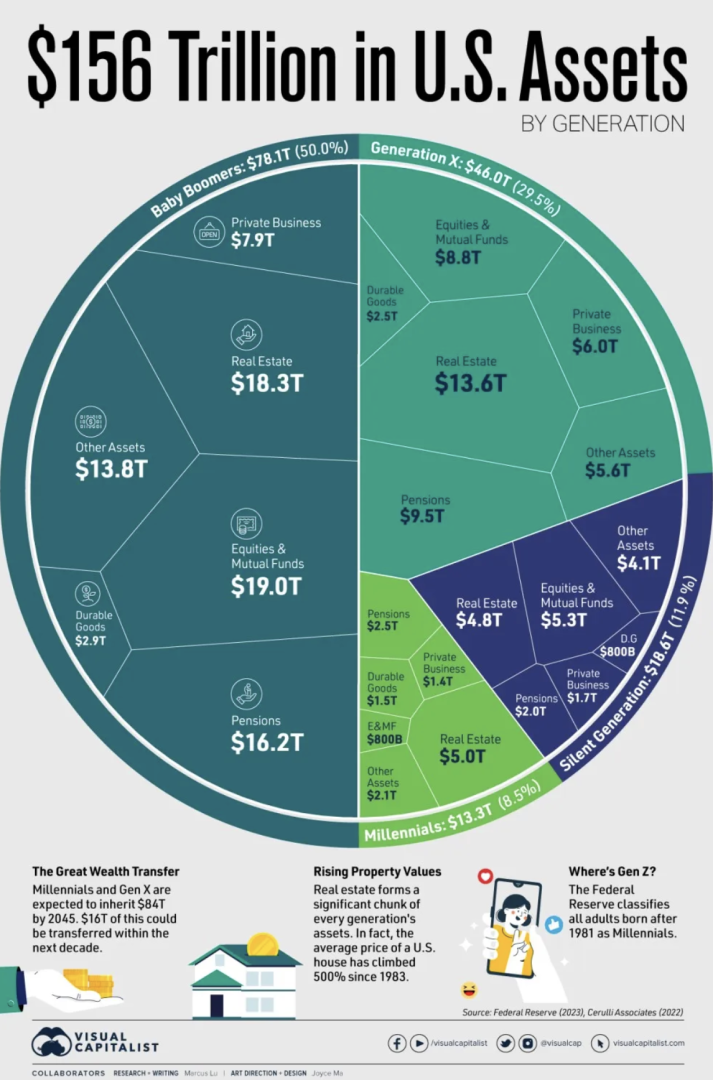

What is this? Estimates of wealth held by the baby boomer generation range from $53-114 T that will either be spent or transferred over the next 20-30 years.

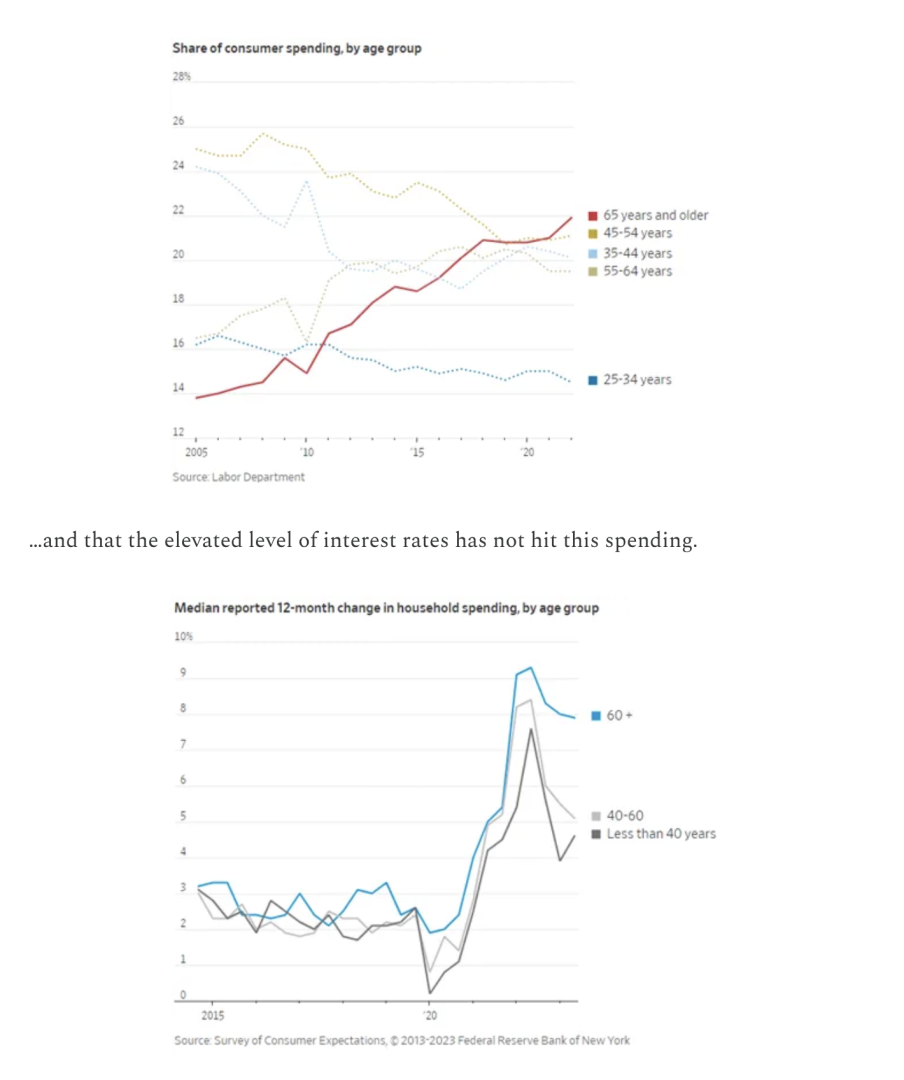

Inflation notwithstanding, there is strong evidence that boomers are spending…

The fact that many, if they still have mortgages, have fixed rates that have not been impacted by the Fed raising short-term rates means they have likely benefited from this rate cycle by seeing increases in returns, both from their T-Bill holding and from the 40-year rise in the value of the stock market.

Since consumer spending is over 67% of GDP, the spending by this boomer cohort has had a huge impact on the economy.

I follow several market commentators: one is Luke Gromen, who publishes The Forest For The Trees weekly; another is Remi Tetot, aka The Mad King. He published a couple of times each month.

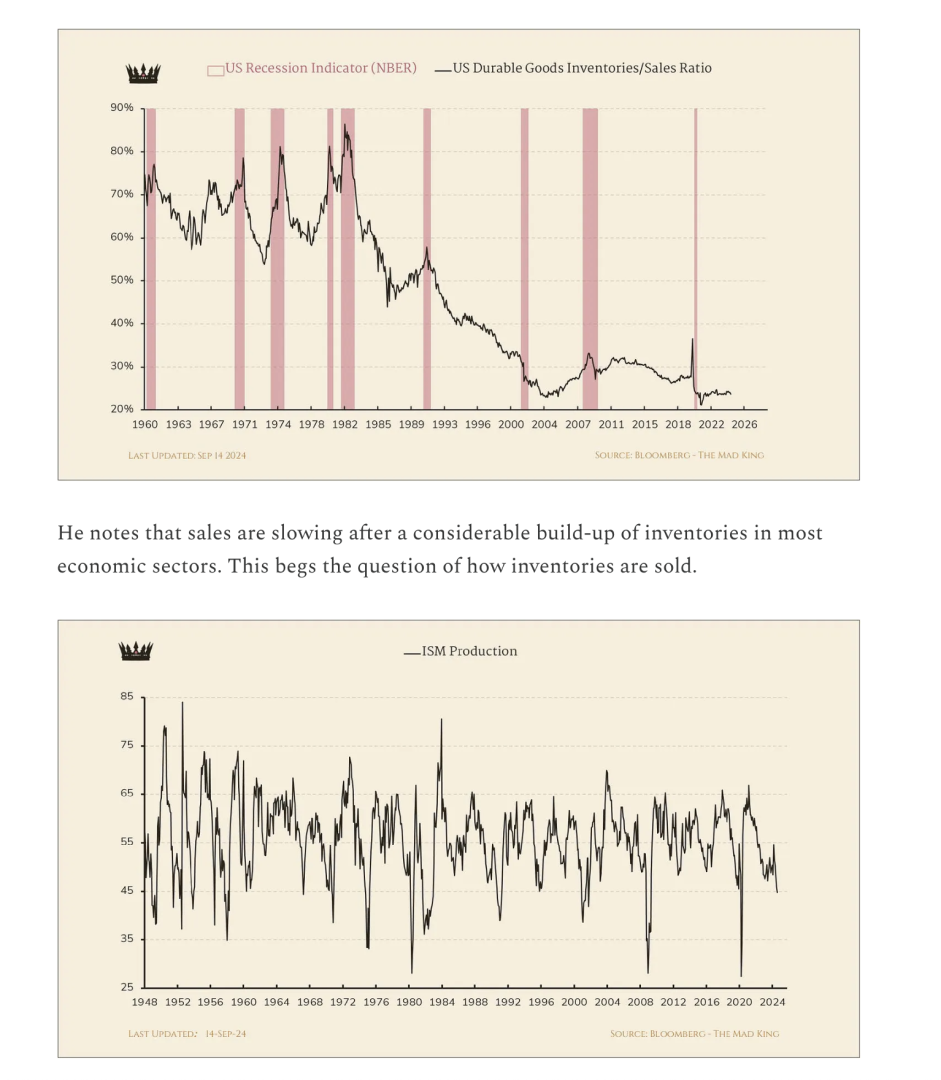

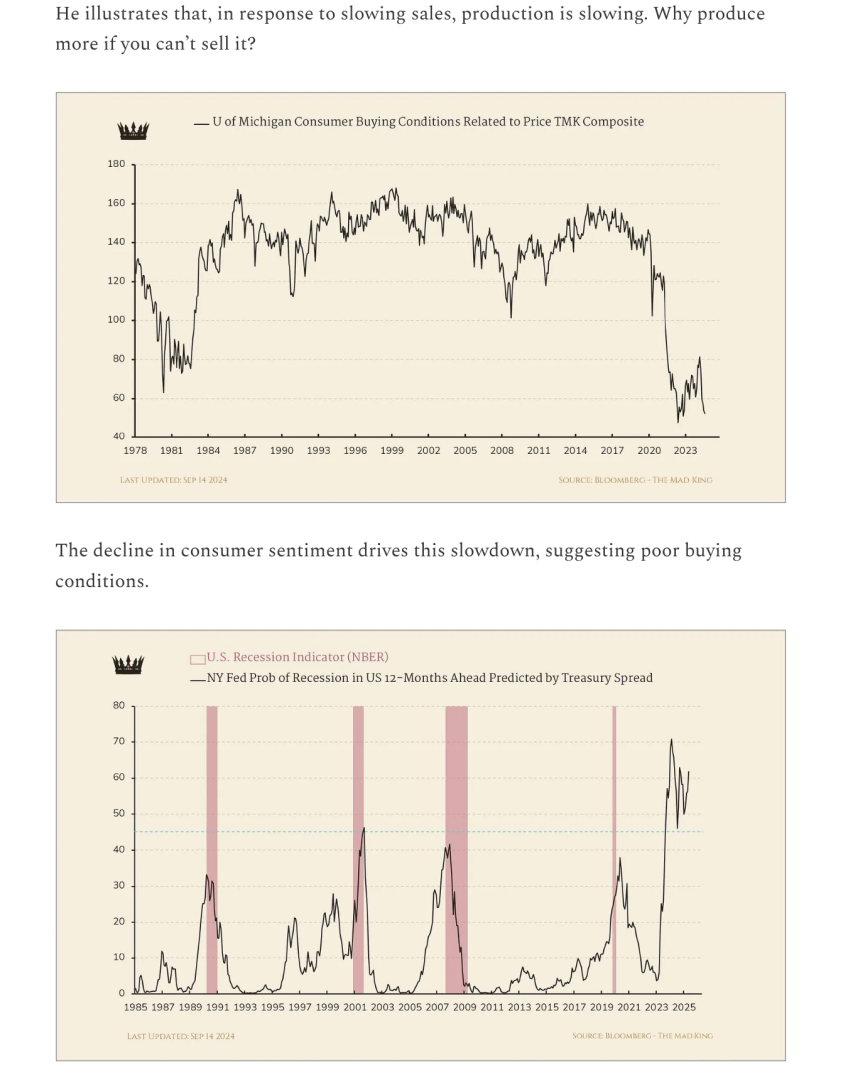

The Mad Kings offers the following charts as evidence of a recession being imminent.

He concludes by saying that the probability of a recession is rising.

Gromen, on the other hand, points out that, with the government counting for ~24% of GDP and, mostly because of interest expense, growing at 2-3% per annum, it is hard to push the economy into recession (measured as two consecutive quarters of GDP contraction).

To push the economy into recession overall, the other 76% would need to contract at 4% or more. We are currently a long way from that.

While technically true, that answer does not paint a particularly rosy picture of the economy. Growing dependence on government spending does not feel very productive.

Growing government debt from $35T to an even larger slice of the economy does not seem to be good for the economy.

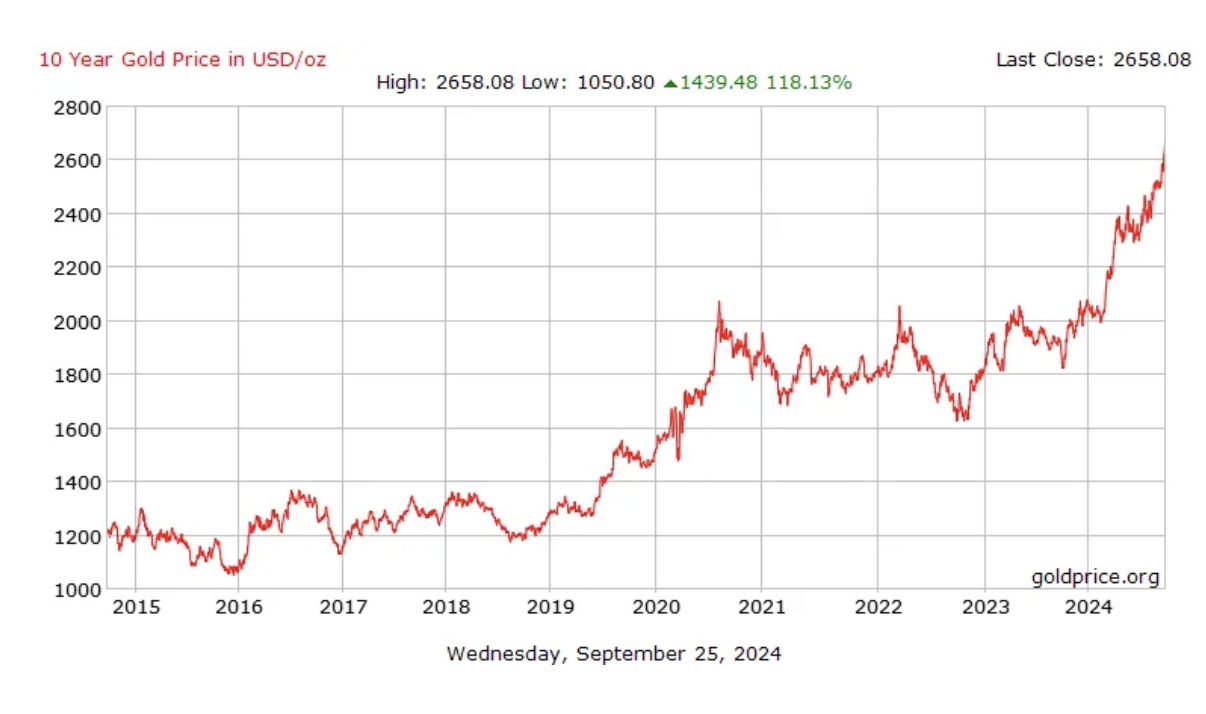

The gold price does seem to reflect this concern.

Developments in the energy market are bullish for the economy because energy is the base layer of all economic activity.

The Fed seems to be doing a good job of managing interest rates, which will help the Treasury refinance the considerable debt burden that will roll over in the next three years.

As short-term interest rates decline, investors will move their assets into longer-term government bonds, stocks, and hard assets such as real estate, gold, and bitcoin.

Although spending and consumer sentiment are under some stress, the dominant cohort—boomers—are spending as if they only live once.

The large impact of government spending and the spending and transfer of boomer wealth are countering technical indicators of recession.

These factors make this bull market different.

Neil is the CEO of Dakota Ridge Capital. He is passionate about solving tax, accounting and regulatory problems for institutions that have invested billions of dollars of capital in multiple jurisdictions. Throughout his career, he has successfully assisted a diverse array of organizations, including hedge funds, insurance firms, banks, and large corporations, in raising capital, developing businesses, and securing tax credits. Neil holds a master’s degree in Law from the University of Cambridge.

Leave your comments

Post comment as a guest