Comments

- No comments found

Stock markets are the first thing that people think of when you mention investing.

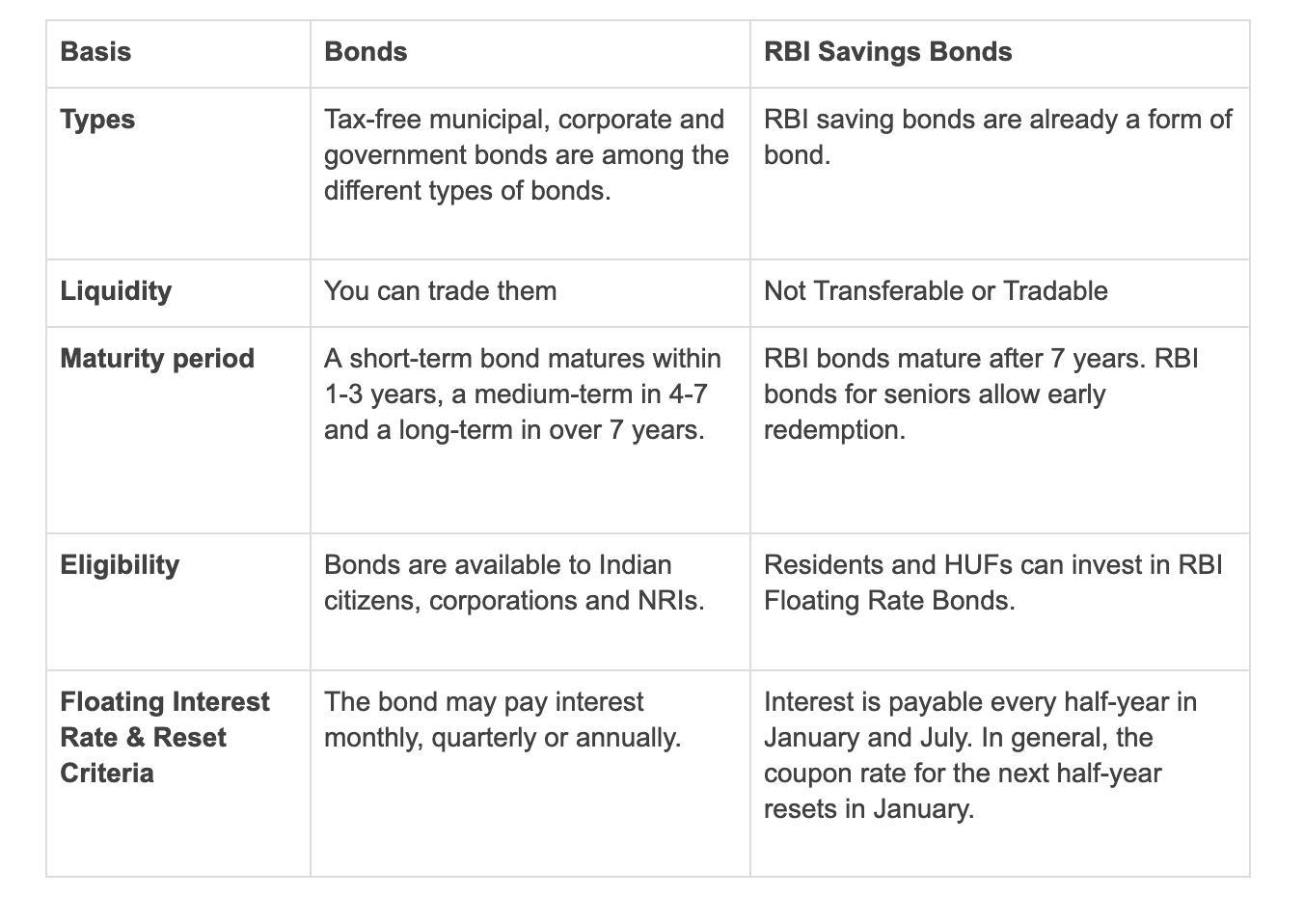

Stock markets are exciting because they can make people wealthy overnight. It comes with some risk. Share prices can rise and fall as fast as they do, causing you to lose all your hard-earned cash. Bonds and RBI savings bonds are now considered reliable investment options, but they may not have been as attractive initially. The jargon is confusing to the average person, especially during bull markets. Bonds and RBI saving bonds are known for their safety and stability, and many investors add them to their portfolios. Continue reading to learn more about the topic.

RBI bonds are some of the safest bonds to invest in. They were first introduced to the nation in 2003. RBI Bonds are issued by the Government of India, and held by Indian citizens. RBI bonds can be purchased from nationalized banks such as Bank of Baroda and State Bank of India. Stock Holding Corporation of India Limited is another place where investors can purchase RBI bonds.

These bonds mature seven years after their issue date.

RBI bonds are due to be repaid 7 years after the date of issue. Certain RBI bonds are eligible for early redemption.

The date on which the subscription payment is received in cash up to Rs. It is the date of receiving subscription payment in cash (up to Rs.

After a period of lock-in of 4, 5 or 6 years the facility is available to investors aged 80 or older, 70-80, and 60-70, respectively.

The minimum amount is Rs. The maximum amount is Rs.

Investors must provide their bank account details to receive direct payments of the interest and maturity value on bonds.

The Government Securities Act 2006 and the Government Securities Regulation 2007 (published on December 1, 2007, in the Gazette of India, Part III, Section 4) allow the sole or joint holder to designate one or several individuals as nominees.

The government guarantees RBI bonds, making them the safest currency investment. The interest rate on these bonds is similar to what banks offer.

The benefits of RBI Savings Bonds

If you want to invest in a long-term income stream,RBI Bonds have a maturity up to seven years and offer reasonable returns.

You are looking for better returns. The interest rate of RBI Floating Rate Savings Bonds is 7.15 percent (from 1st Jan 2022 to 30th June 2022). These bonds offer slightly higher returns than FDs.

Businesses issue bonds when they need massive capital to grow. When the government needs funds to fund social services or infrastructure, it issues Bonds. Investors lend a portion of the money needed to fund the project. In the same way that loans are similar to bonds, the investor is the lender. The firm that sells the bonds is called the issuer. Here are some reasons why bonds should form part of your portfolio.

High-Yield Bonds offer higher returns than RBI Savings Bonds. They can yield up to 12 % per annum.

Bonds are the most reliable and consistent source of income. You have many options for building an income-producing portfolio, even when interest rates are low. These strategies include high-yielding bonds and debt in emerging markets.

When it comes to investing, “Don't place all your eggs into one basket” is good advice. Investors are especially at risk. Bonds can help equity investors maintain their wealth if the stock market drops.

Bonds are ideal for those who want to preserve their capital while still achieving growth. This may be the case for someone who is nearing retirement or a parent with a child entering college. Diversifying your bond portfolio will reduce the risk of substantial losses.

Bonds and RBI Savings Bonds both offer a safe investment. Bonds are more flexible and offer higher returns than RBI savings bonds, making them a more appealing investment option.

Leave your comments

Post comment as a guest