Renewable Energy, Politics, and Tax Benefits

Renewable Energy, Politics, and Tax Benefits

The Inflation Reduction Act (IRA) has been a game-changer for the renewable energy industry, offering substantial tax benefits that have sparked unprecedented investment in clean technologies.

However, as with any major legislation, its effects aren’t uniformly distributed, and where these benefits are happening is surprising. Despite opposition from many Republican lawmakers, the bulk of these incentives are landing in red states—a political twist that raises questions about how these benefits are allocated, why people love tax breaks so much, and whether the IRA is truly sound policy. In this article, we'll dive into the geographic, political, and economic factors shaping the IRA's impact, and why, despite its critics, it may be here to stay.

Where Are the IRA Benefits Happening?

The Inflation Reduction Act (IRA) has drastically reshaped the renewable energy landscape, channeling tax benefits to developers and investors. This has raised important questions about where these benefits are actually going, and why.

One of the first questions I often hear is, “Won’t Trump repeal this legislation if he’s elected?” It’s a valid concern, especially given the political climate. Presidential candidates often seem willing to promise anything to secure votes. Trump, for instance, could appeal to his base by pledging to kill off renewable energy—EVs, solar panels, and wind turbines. It’s red meat for his audience, or so he thinks. Similarly, Harris might embrace something like fracking if it aligns with what her target voters want, even if she previously opposed it.

Changing positions isn't inherently a bad thing, but the shift should be credible. Unfortunately, most voters aren’t buying that their wildest dreams are about to come true.

Here’s one of the biggest ironies of the IRA: while Trump might want to repeal it, the majority of the benefits are landing in red states.

According to a recent feature from Bloomberg, a stunning 78% of cleantech investments made under the Biden administration have flowed to Republican-led districts:

$42 billion in Democratic House districts

$18 billion pre-IRA

$24 billion post-IRA

$161 billion in Republican districts

$57 billion pre-IRA

$105 billion post-IRA

Of the 51 cleantech projects in the country that exceed $1 billion in value, 43 are in red districts. In fact, 21 of the top 25 districts for cleantech manufacturing investment are represented by Republicans, accounting for $119 billion in investment and over 80,000 jobs.

Why Has This Happened?

Is this some clever political maneuvering to win over Republican support by bringing money and jobs to their base? Possibly. It’s reminiscent of when Trump struggled to repeal the Affordable Care Act—by the time he tried, too many people had grown accustomed to their new healthcare benefits. As much as politicians might posture, once voters enjoy these tangible benefits, they’re not eager to give them up.

But there are practical reasons why red states are seeing more IRA benefits. These regions tend to have:

Looser permitting regulations

Cheaper, more plentiful land

Favorable labor laws

More sun and wind resources

These factors naturally make them prime locations for large-scale renewable projects. Politicians in these districts who vote against the IRA will face an uphill battle in justifying their opposition, as the economic incentives have already taken root.

Why Do People Love Their Tax Benefits?

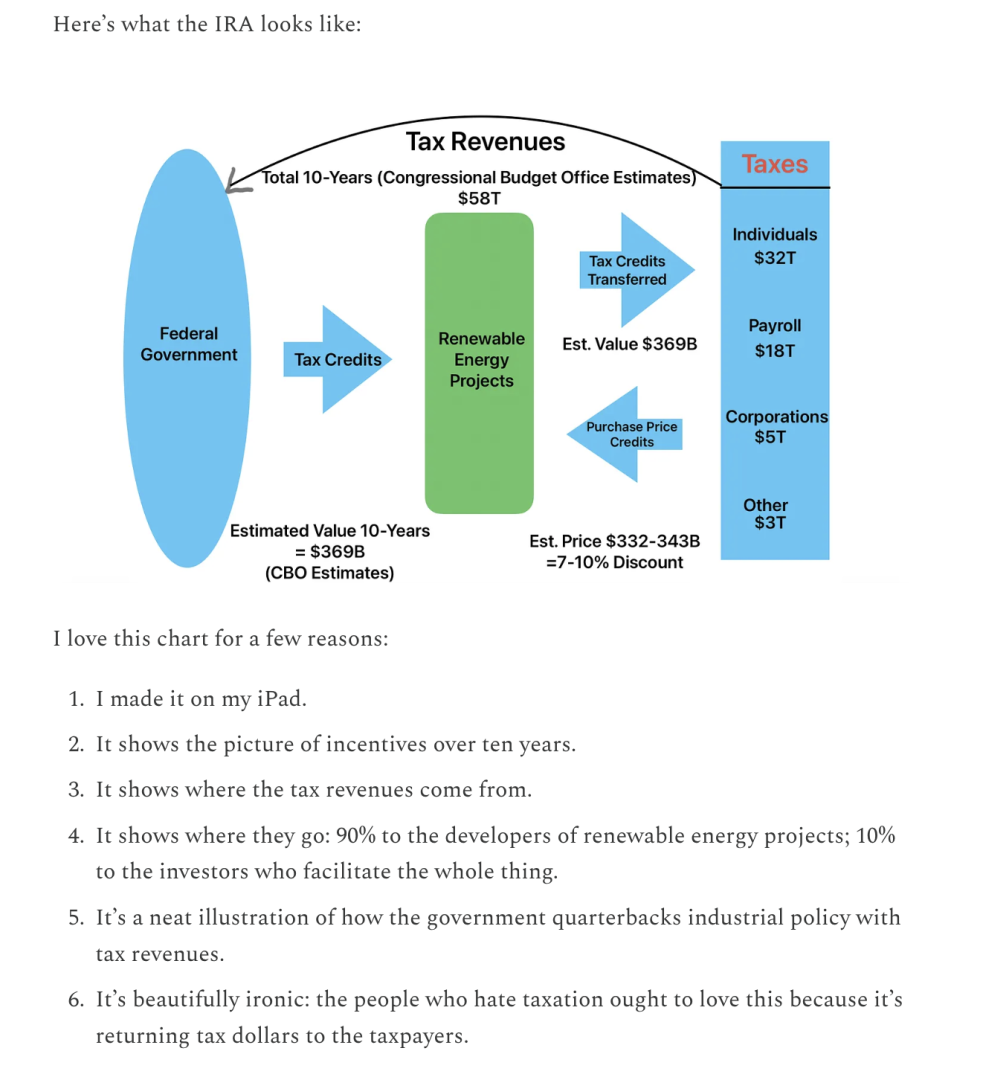

The IRA allocated $369 billion in tax benefits over a decade. However, these benefits are uncapped, meaning that if developers bring $1.5 trillion worth of projects to the table, the government will still offer the tax credits—as long as it can divert that much tax revenue.

This brings up a broader point: people have a complicated relationship with taxes. They dislike paying them, but they love the benefits that tax-funded projects provide—roads, bridges, defense, and social programs. And when it comes to renewable energy, the government is essentially returning tax dollars to taxpayers, which makes even the staunchest opponents of taxation rethink their stance.

One of the most interesting aspects of these benefits is how they are distributed between developers and investors. Developers receive 90% of the tax credits, while investors facilitating the projects take 10%. This creates an effective partnership between the government and the private sector in directing tax revenues toward green infrastructure.

Passive Income: The Key to Unlocking Benefits

This is where things get a bit more technical, but it’s important. For individuals to take advantage of the IRA credits, they must have passive income. While most people think of passive income as earnings from investments, the IRS defines it differently. According to the IRS, passive income comes from:

Trade or business activities where the individual does not materially participate.

Interests in partnerships, S-corporations, or limited liability companies (LLCs) that conduct such activities.

Equipment leasing.

Rental real estate.

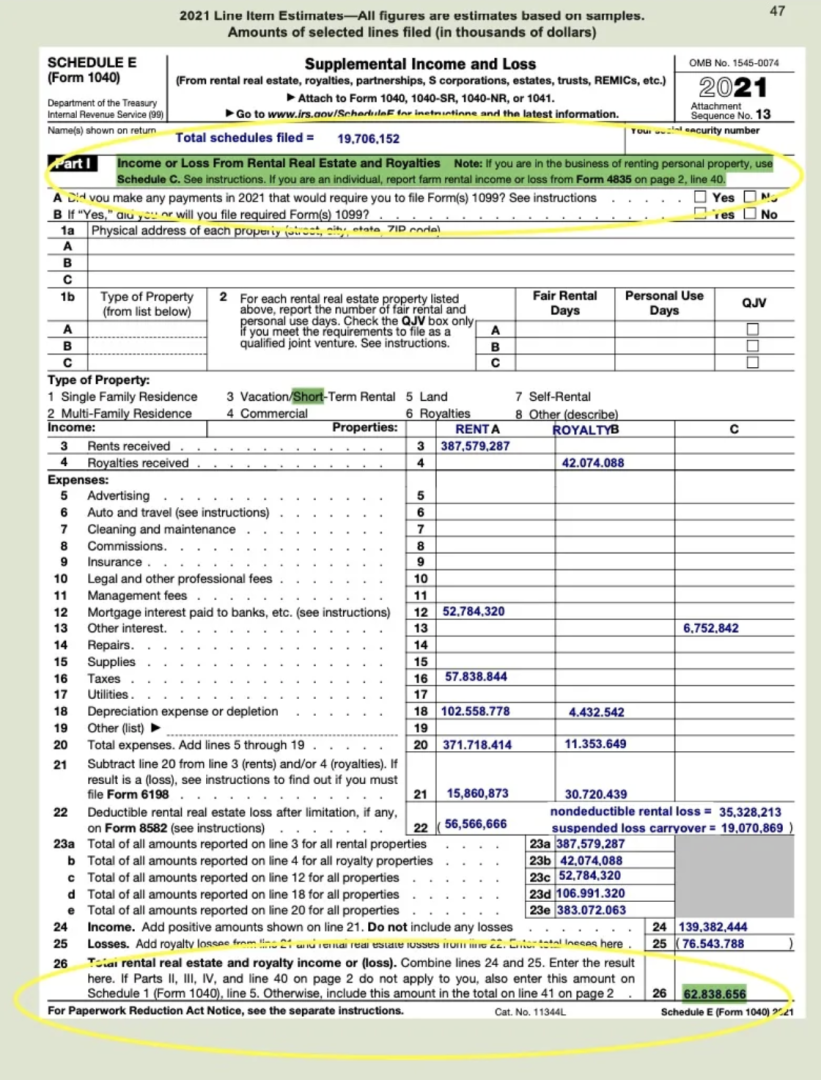

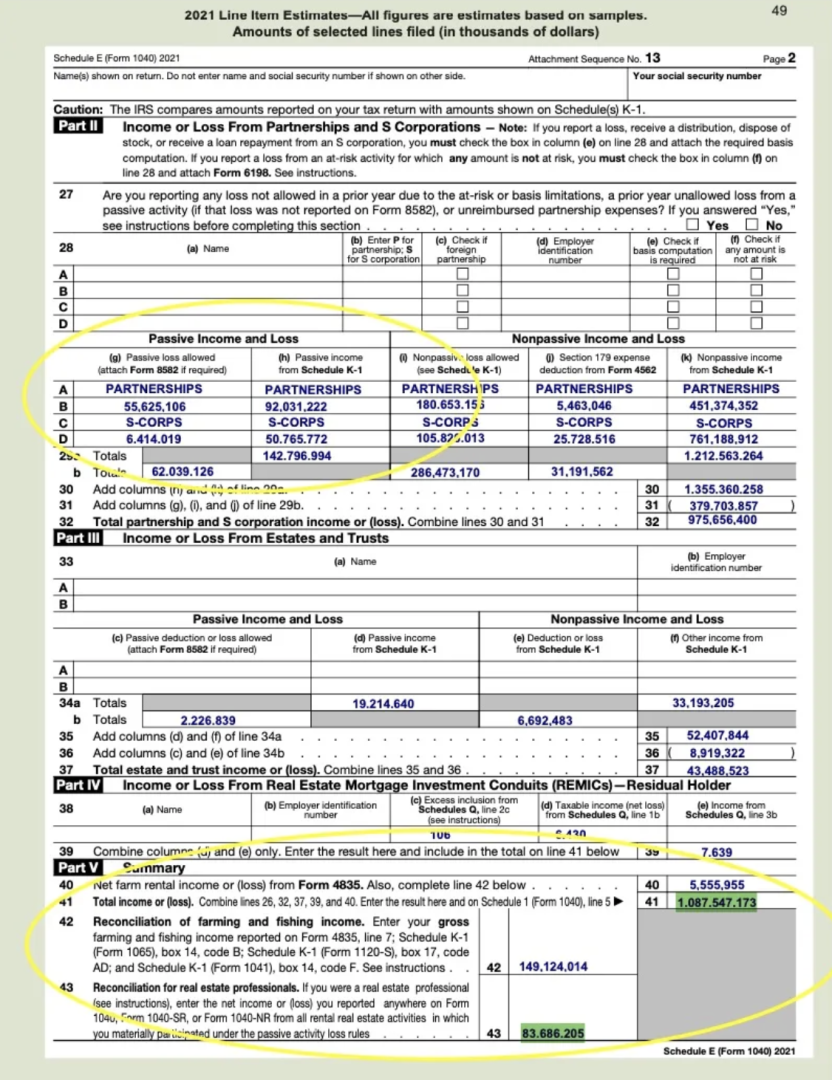

Interestingly, income from stocks, dividends, interest, and capital gains is considered portfolio income, which cannot be offset by IRA tax credits. The available IRS data for 2021 shows:

$62 billion in passive income from rental and real estate

$143 billion in passive income through partnerships

With the top 1% of taxpayers paying an average tax rate of 26%, this translates into about $53 billion in potential tax offsets for renewable energy credits.

Is This Ill-Conceived Policy?

The IRA has its critics. Some argue that it isn’t doing much to fight inflation, as its name implies, and there are legitimate concerns about the effects of intermittent energy sources on grid stability, land use, and the long-term environmental impact of these massive projects.

Additionally, the cost of backing up renewable energy sources with traditional power plants during off-peak production times (e.g., cloudy days, windless nights) is a real challenge. Still, just as you can’t fight the Federal Reserve, it’s hard to fight the incentives laid out in the IRA. These projects are going to move forward, and the economic benefits are too powerful for many to resist.

It’s also worth noting that the IRA is an “all of the above” approach to energy. The recommissioning of nuclear plants, like the Three Mile Island facility, will create jobs and tax revenue while benefiting from IRA credits. Other areas, like fugitive methane mitigation and carbon capture, are also receiving incentives under this policy.

Key Takeaways

The fact that the IRA benefits have disproportionately fallen to red states may insulate the legislation from being repealed by a future Trump administration.

This outcome reflects how the government is effectively nudging the private sector and letting market forces determine where the chips fall.

Expanding tax benefits to individuals, not just corporations, is crucial—and I’m happy to be working on fixing that.

Encouraging private sector competition across a range of energy technologies—wind, solar, nuclear—makes the IRA a smart and forward-thinking policy.

Neil Winward

Taxation Expert

Neil is the CEO of Dakota Ridge Capital. He is passionate about solving tax, accounting and regulatory problems for institutions that have invested billions of dollars of capital in multiple jurisdictions. Throughout his career, he has successfully assisted a diverse array of organizations, including hedge funds, insurance firms, banks, and large corporations, in raising capital, developing businesses, and securing tax credits. Neil holds a master’s degree in Law from the University of Cambridge.

Trending

1 UK Braces for Widespread Snow According to Met Office

Susanna Koelblin2 Physical Realities of Moving to Cleaner Energy

Timothy Taylor3 Eco-Conscious Kids: A Guide to the Best Sustainable Outdoor Toys

Susanna Koelblin4 Deep Tech Ethics Trifecta: Building a Responsible and Sustainable Global Innovation Ecosystem

Dr. Ingrid Vasiliu-Feltes5 Understanding Downdraft Tables: Enhancing Your Welding Environment

Daniel Hall